Bangladesh worst offender in ICT tax

Bangladesh worst offender in ICT tax

Washington-based organisation says high tax puts a drag on economy

The government has drastically inflated the prices of ICT goods and services in Bangladesh, adding about 60 percent to their cost above the basic price, which is the highest in the world, a recent study by a Washington-based research organisation found.

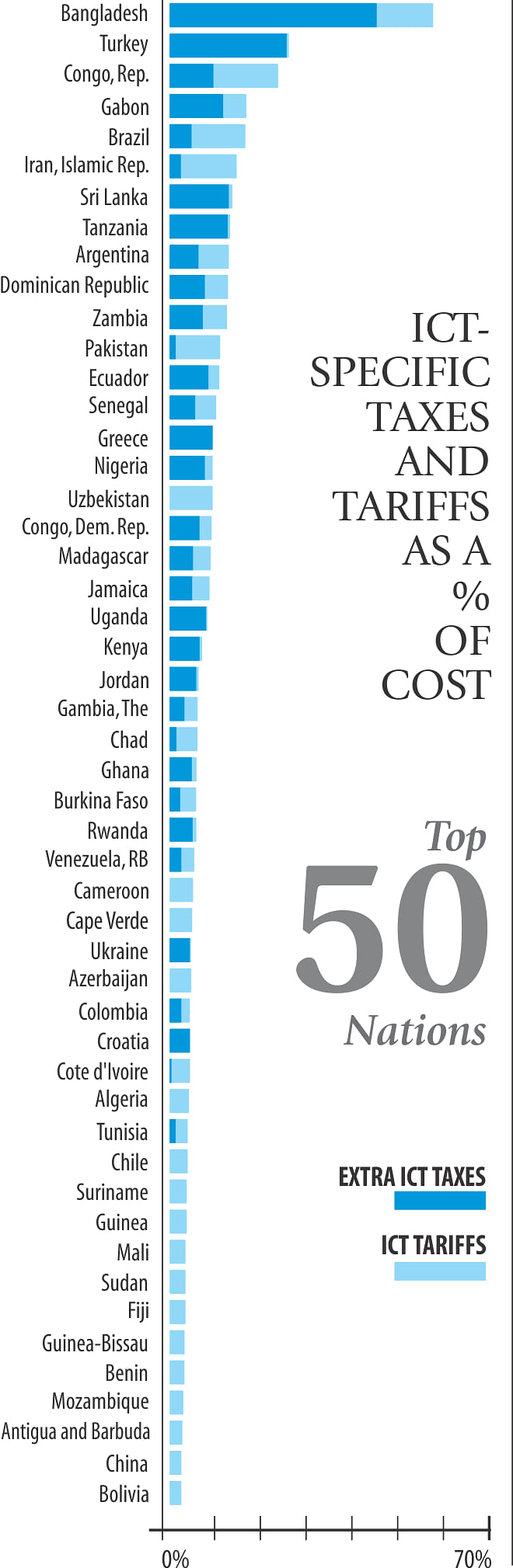

Additional costs come through two main channels: discriminatory taxes and tariffs, the Information Technology and Innovation Foundation said in the report, Digital Drag, which ranked 125 nations.

In Bangladesh, 57.8 percent is added to the cost of ICT goods and services over and above the country's universal 15 percent VAT.

The extra costs the government imposes can be expressed most clearly as a percentage increase in the costs of goods and services. “The worst offender by a large margin is Bangladesh,” the report said.

In the second and third place are Turkey and the Republic of the Congo, which add 26.1 percent and 23.8 percent, respectively.

“It's one thing to tax things like cigarettes and alcohol at a higher rate because it makes sense for governments to want to limit consumption of these kinds of products. But to do this for one of the most important technologies to drive productivity and innovation is self-defeating,” Robert D Atkinson, one of the co-authors of the report, said.

The report found at least 31 countries, most of which are in the developing world, are imposing high taxes on top of other sales or VAT. This is threatening to impede economic growth and slow consumers' adoption of smartphones and broadband internet.

For instance, in Bangladesh, the telecom infrastructure providers pay 55 percent taxes to import capital equipment and 24 percent for optical fibre cable. Mobile handsets are slapped with 21 percent duty when they enter the country.

“Mobile phones are the most widely accessible form of ICT available in countries like Bangladesh. The evidence suggests that it is counter-productive to treat ICTs as demerit goods and tax them over above what other goods are. If anything, there is a case for lower-than-normal taxes,” Rohan Samarajiva, founder chairman of LIRNEasia, a Colombo-based ICT think-tank, told The Daily Star.

Dilip Pal, chief financial officer of Grameenphone, said the telecom sector in Bangladesh is faced with the highest tax rates in the world; the higher taxes make it harder for operators to extend even lower rates to customers and still remain a business.

“In light of chronic declining average revenue per user' figures, in my opinion, higher tax rates only deter adoption of IT solutions among the majority of potential IT service users -- which is definitely not good for the country going forward.”

Mustafa Jabbar, former president of the Bangladesh Computer Samity, said on one hand, the government wants to implement the vision of a 'Digital Bangladesh' but on the other hand, it is imposing 15 percent value-added tax on internet use or Tk 300 SIM tax. “It's conflicting.”

The government wants to put computers in the hands of students but it is not withdrawing the duties on the ICT sector, he said. “There should not be any VAT or tax on ICT. Rather, the government should subsidise the sector.”

In contrast, the richer countries were found to impose lower taxes -- the US adds 2.4 percent and the European nations have even lower tax levels, it said. There is clear economic evidence that higher taxes and tariff on ICT goods and services reduce adoption, the report said. This is because the adoption of ICT depends on its price, particularly in low-income countries.

As businesses spend less on computers and other information technologies, their productivity growth slows, it said. Similarly, consumers purchase fewer mobile phones and less broadband access limits e-commerce, which, in turn, slows economic growth. High levies can trim per capita income by as much as 2.3 percentage points a year, according to the report.

Atkinson, also the foundation's president, said that levies around the world were on the rise “as nations seek to grow their own domestic ICT industries and see tariffs as silver bullet”.