20 jute mills shut for low demand

20 jute mills shut for low demand

Many more factories are vulnerable as govt is yet to implement a packaging law for compulsory use of jute sacks

Around 20 jute mills were shut down in the last 7/8 months due to a depressed international market and currency devaluation in India, industry people said.

Another major reason behind the closure of the factories that used to make sacks, bags and yarn is the government's failure to implement a packaging law for compulsory use of jute sacks to pack food grains and other items.

The domestic demand would get a boost if the law was implemented properly, they said.

“The current adverse situation has forced us to lay off workers temporarily,” said Kaihan N Rahman, deputy managing director of 40-year-old Pubali Jute Mills.

Pubali used to make mainly jute sacks and bags and export those to countries like India, Thailand, Egypt, Syria, Turkey, Iraq and Sudan. Most of these markets have been facing political turmoil for months, while devaluation of the Indian currency has shrunk Bangladesh's exports of jute and jute goods there.

“Our condition has worsened in the last 7/8 months. Many more factories will be closed down soon if the situation doesn't improve,” said Abdul Barik Khan, secretary of Bangladesh Jute Mills Association (BJMA).

According to BJMA, 5/6 jute mills, including Pubali, Mohsin Jute Mill and Ajax Jute Mills, were closed in the last several months.

Khan said many mills are running partially and may be shut down anytime.

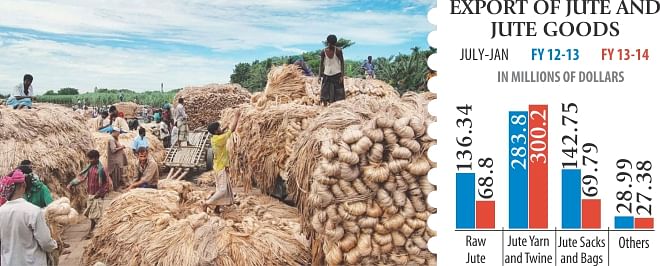

Bangladesh exported jute and jute goods worth $466 million during the July-January period of the current fiscal year, according to Export Promotion Bureau data.

The earnings in the period declined by more than 21 percent year-on-year and fell 28 percent short of the target.

Exports of raw jute and jute sacks and bags plunged by a half so far this fiscal year. However, exports of jute yarn and twine that account for half of the country's total exports of jute and jute goods increased by nearly 6 percent during the first seven months till January this fiscal year.

“Sluggish demand in the international market, especially in India, has affected our exports,” said Gopi Kishon Sureka, managing director of Fiber n Fibre, an exporter of raw jute and jute products.

The fall of the Indian rupee has eroded Bangladesh's competitive advantage over the Indian exporters, he said.

There are 94 spinning mills in the country, of which around 15 were closed down in the last 7/8 months, according to Bangladesh Jute Spinners' Association. Many more mills are running below their capacity.

“Our situation is grave. The global demand has gone down, while production cost has increased,” said Shabbir Yusuf, president of the association.

Yusuf said Syria was a big market for Bangladesh's jute yarn and used to import around 70,000 tonnes of yarn a year. But this market is totally off now because of the ongoing political unrest there, he said.

Export to Iran that used to import around 40,000 tonnes of yarn a year from Bangladesh is also at a halt because of US sanctions against the country, he said.

However, industry players said the implementation of the mandatory packaging law could rescue the local millers by increasing demand in the domestic market.

Though the law was passed in 2010, the government is yet to implement it mainly due to an absence of associated rules and regulations. But India, a strong competitor of Bangladeshi jute millers, implemented such a packaging law in 1987.