Bad loans soared 20pc in 2017

Banks' default loans surged 19.51 percent in 2017, as the Bangladesh Bank's efforts to rein in bad loans are going to vain.

On January 1, 2017 the sector's total default loans were Tk 62,172.32 crore; on December 31, 2017, it stood at Tk 74,303 crore.

“Financial scams have fuelled up default loans in the banking sector,” said Khondker Ibrahim Khaled, a former Bangladesh Bank deputy governor.

State banks are mainly responsible for the scam that later spilled over to the entire banking sector, he said.

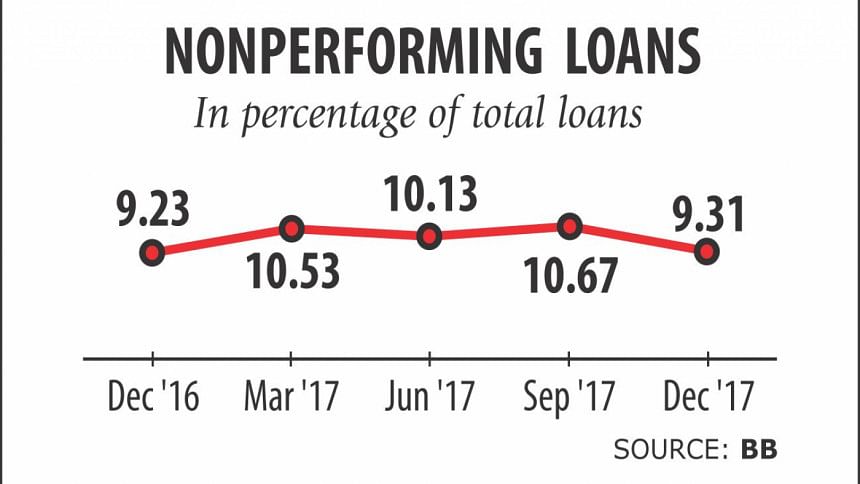

In terms of percentage, the sector's nonperforming loans accounted for 9.31 percent of the total outstanding loans at the end of 2017. At the beginning it was 9.23 percent, according to central bank statistics.

However, in the last quarter of 2017, default loans shrunk 7.48 percent from the previous quarter, as banks went on their typical end-of-year recovery push to post flattering numbers.

For instance, Agrani Bank managed to recover Tk 1,860 crore in the last three months of 2017 -- a recovery record for the state-owned lender, according to its Managing Director Mohammad Shams-Ul Islam.

“All banks went on a special drive to bring down the classified loan total, which reflected in the last quarter's figure,” he added.

At the start of 2017, the six state-banks' total default loans stood at Tk 31,025.87 crore. During the course of the year, it swelled 20.30 percent to Tk 37,326 crore.

“Default loans of many banks are still hovering in the double-digit territory,” said Md Ataur Rahman Prodhan, managing director of Rupali Bank.

Banks' default loans tend to decrease in June and December to enjoy net profits, said MA Halim Chowdhury, managing director of Pubali Bank.

“It is an age-old phenomenon,” he said, while advising banks to sustain the recovery drive all year long.

The private banks' default loans soared 27.23 percent to Tk 29,396 crore last year.

The irregularities have recently spilled over into the private banks, according to Khaled.

The financial health of some first and fourth generation banks have gradually deteriorated and the big sums of default loans also had an adverse impact on the banking sector, he added.

The two specialised banks, Bangladesh Krishi Bank and Rajshahi Krishi Unnayan Bank, saw their default loans balloon 23.60 percent to Tk 5,426 crore.

The foreign banks though saw their default loans shrink 0.39 percent during the course of 2017 to Tk 2,154 crore.

“Banks had artificially decreased their default loans in the last quarter as they had written off huge amounts of loan in recent months,” said AB Mirza Azizul Islam, a former caretaker government adviser.

The interest rate on lending would have declined if the default loans had actually shrunk, Islam said.

A BB official said that the central bank had allowed some banks to reschedule their default loans on case-to-case basis.

The central bank's policy also helped to bring down their classified loans.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments