Bangladesh Bank (BB)

BB to hike policy rate in two phases to fight inflation

The Bangladesh Bank will increase the policy rate twice and interest rate once by October to tame double-digit inflation, central bank Governor Ahsan H Mansur said at a press briefing yesterday.

Five crisis-hit banks secure BB guarantee for liquidity

Five crisis-hit banks have obtained a Bangladesh Bank (BB) guarantee to avail liquidity support from the inter-bank money market, according to central bank officials.

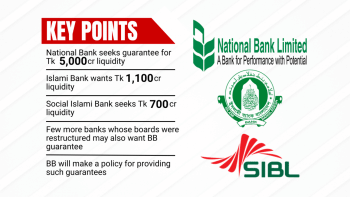

Three banks seek BB guarantee for Tk 6,800cr liquidity support

National Bank, Islami Bank Bangladesh and Social Islami Bank have applied to the Bangladesh Bank (BB) for its guarantee to avail a total of Tk 6,800 crore in liquidity support through the inter-bank money market for a period of three months.

Arif Quadri resigns as UCB managing director

Arif Quadri, managing director and CEO of United Commercial Bank (UCB), formally resigned from his post today. He had been absent from office ever since the Sheikh Hasina-led Awami League government was ousted by a mass uprising on August 5

Can we change the story of our ailing banks?

Restoring trust in the banking sector is crucially important

Central bank not blocking any business accounts: Governor

BB is not blocking or interfering with the accounts of any businesses, regardless of their political affiliations, said BB Governor Ahsan H Mansur

Interest rate spread rises to highest level since 2003

The spread between interest rates on deposits and loans rose to 6.03 percent, the highest in two decades, indicating that banks are making money at the expense of depositors and borrowers.

The renaissance of Bangladesh Bank and some expectations

We hope that the BB governor will continue the momentum and spirit to bring order and promote the economy.

A laundry list for BB governor

A new governor has joined the central bank of Bangladesh. As a leading macroeconomist, he has rightly identified inflation and the lack of discipline in the banking sector as the main culprits to be addressed. Both issues are very important, there’s no doubt about it.

BB to hike policy rate in two phases to fight inflation

The Bangladesh Bank will increase the policy rate twice and interest rate once by October to tame double-digit inflation, central bank Governor Ahsan H Mansur said at a press briefing yesterday.

Five crisis-hit banks secure BB guarantee for liquidity

Five crisis-hit banks have obtained a Bangladesh Bank (BB) guarantee to avail liquidity support from the inter-bank money market, according to central bank officials.

Three banks seek BB guarantee for Tk 6,800cr liquidity support

National Bank, Islami Bank Bangladesh and Social Islami Bank have applied to the Bangladesh Bank (BB) for its guarantee to avail a total of Tk 6,800 crore in liquidity support through the inter-bank money market for a period of three months.

Arif Quadri resigns as UCB managing director

Arif Quadri, managing director and CEO of United Commercial Bank (UCB), formally resigned from his post today. He had been absent from office ever since the Sheikh Hasina-led Awami League government was ousted by a mass uprising on August 5

Can we change the story of our ailing banks?

Restoring trust in the banking sector is crucially important

Central bank not blocking any business accounts: Governor

BB is not blocking or interfering with the accounts of any businesses, regardless of their political affiliations, said BB Governor Ahsan H Mansur

Interest rate spread rises to highest level since 2003

The spread between interest rates on deposits and loans rose to 6.03 percent, the highest in two decades, indicating that banks are making money at the expense of depositors and borrowers.

The renaissance of Bangladesh Bank and some expectations

We hope that the BB governor will continue the momentum and spirit to bring order and promote the economy.

A laundry list for BB governor

A new governor has joined the central bank of Bangladesh. As a leading macroeconomist, he has rightly identified inflation and the lack of discipline in the banking sector as the main culprits to be addressed. Both issues are very important, there’s no doubt about it.

Unrest in banking sector raises concerns

Unrest has gripped the banking sector at a time when several banks are burdened with huge default loans and are suffering from low asset quality.