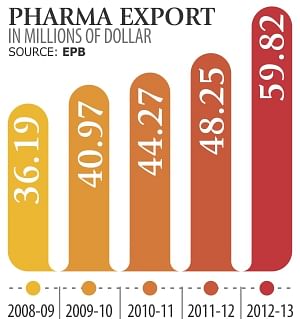

Pharma exports rise on growing demand

Pharma exports rose around 24 percent year-on-year to $59.82 million in fiscal 2012-13 thanks to a growing demand for Bangladeshi medicines in Southeast Asia, Asia Pacific and Africa.

“The actual potential is even higher. The country needs to improve its infrastructure and capabilities and the manufacturers should have adequate support from the government to realise that potential,” said Rabbur Reza, chief operating officer of Beximco Pharma.

Reza said they are now focusing on developed markets such as Europe, Australia, Latin America and Gulf countries. "We have already started exporting to Germany and Austria and are getting a very good response from these stringently regulated markets.”

The government has declared the pharma industry a thrust sector due to its huge export potential, he said

Bangladesh is almost self-sufficient in pharmaceuticals as local companies can meet nearly 97 percent of the domestic demand, he said.

Bangladeshi companies have also earned trust globally, said Dewan Abul Bashar, manager for international sales operation at Square Pharmaceuticals.

Local companies are working to establish their brands in different international markets such as South Asia, Africa, Latin America and the EU, Bashar said.

Bangladeshi companies have successfully created demand, which has boosted exports, he said, adding that Square is focusing on marketing on the global front to develop medicine prescribers' confidence.

However, the country will have to go a long way to establish itself as a generic drug hub, as it needs to strengthen capabilities in several key areas, said Reza of Beximco.

“We need to upgrade our research and development skills in producing technology driven, specialised niche products such as sterile ophthalmic products, inhalers, lyophilised injectables, transdermal patches and biologics.”

Bangladesh also needs to strengthen its capabilities in regulatory and legal affairs for the sake of the industry, Reza said.

“The government should build a park for active pharmaceutical ingredients (API) with a focus on developing synthetic chemistry skills.”

API is the substance in a pharmaceutical drug or a pesticide that is biologically active. Synthetic chemistry is the subject which teaches how to do chemical synthesis to develop medicine.

API know-how is crucial to be competitive in the global marketplace and Bangladeshi companies are still dependent on import from India and China, the two major generic drug producers, Reza said.

“In most cases, APIs have to be imported from abroad, which is one of the main disadvantages in terms of cost when compared to India,” said BRAC EPL, a stockbroker.

Bio-equivalence (BE) testing is mandatory for product registration in developed markets and Bangladeshi companies have to spend a huge sum for outsourcing this as the country has no BE testing facility, Reza said.

“Bangladesh's only central API park was supposed to be completed by 2012 and as of now its fate is uncertain which leaves the entire industry at stake as we are still heavily dependent on API import,” he said.

The government should come forward with incentives to develop the sector, he said.

The incentives include developing a special economic zone for pharma, setting up a temperature controlled warehouse at airport, offering cash and tax benefits, encouraging research and development, creating a modern drug testing laboratory, developing API infrastructure, and easing remittance regulation, he said.

With a renewed focus on reverse engineering skills, regulatory and legal affairs, and developing skills across the pharma value chain, Bangladesh has the potential to become a global generic drug hub in future, he said.

The country's pharma market is currently valued at $1.3 billion a year and has created around one lakh jobs. The global pharma market is estimated to be around $1 trillion and the size of the generic drug market stands at $200 billion.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments