Most mobile payment agents profitable: study

Ninety-six percent of mobile payment agents in Bangladesh are making profits, thanks to low operational costs, a testament to how popular the service has become in just a few years, according to a study.

The rest are either incurring losses or at break-even, said a report by MicroSave, an international financial inclusion consultant.

The study -- Agent Network Accelerator Survey -- was conducted by MicroSave with financial support from the Bill and Melinda Gates Foundation. It was published at a hotel in Gulshan, Dhaka yesterday.

The study focused on the central role of mobile money agents in Bangladesh and was disseminated by Helix Institute of Digital Finance, an organisation based in Nairobi. The mobile financial service is experiencing amazing growth in Bangladesh that has a population of 157 million. About 22 percent of the adult population is using these services being provided by a number of banks in association with mobile operators.

In 2013, registered mobile money accounts in Bangladesh grew faster than in any other country, according to the report.

The number of registered customers is 2.07 crore and the number of agents is 477,920, according to the Bangladesh Bank website.

The report said Bangladesh has created many unique systems for agent network management in the mobile financial sector that is yielding world class results, especially in regards to liquidity management.

"The high level of profitability is due to low operational expenses in running an agency in Bangladesh, primarily driven by the fact that over 90 percent of agents have pre-existing, alternate businesses," it said.

On average, an agent conducts 30 transactions a day, and often charges more than 20 percent for a transaction, said Denny George, a specialist at MicroSave, while presenting a summary of the report.

In Kenya, which is considered the most successful mobile financial service providing country in the world, 14 percent of agents are reported to be incurring losses.

Kenya's M-Pesa is recognised as a global leader in digital finance.

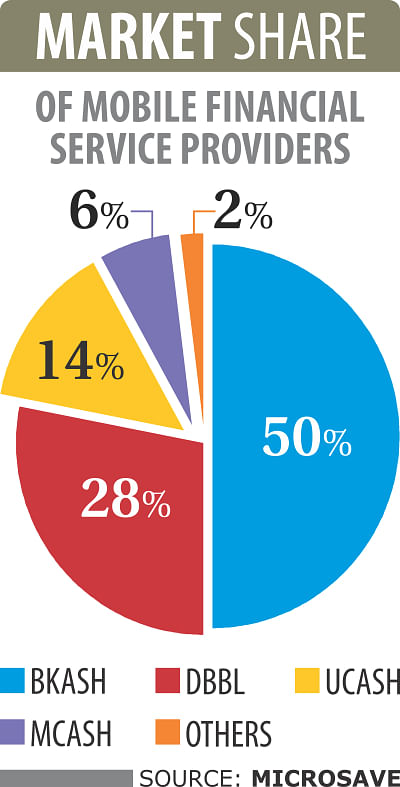

In Bangladesh, bKash, a joint venture between BRAC Bank and Money in Motion in the US, is the largest company to offer mobile financial services, with 50 percent of the market share in terms of agents.

Dutch-Bangla Bank Ltd, the first bank to offer such a service in Bangladesh, came in second with 28 percent of agents and UCash of United Commercial Bank Ltd with 14 percent, said George.

Three years after launch, bKash has over 80,000 agents and is the second largest mobile money service provider in the world, in terms of individual accounts, according to the report.

Speaking at the report's launch, Dashgupta Asim Kumar, former executive director of Bangladesh Bank, said, “Now we have 120 million mobile SIM-card holders. I am sure all the mobile sets will turn into mobile wallets in the next five years. A big share of retail banking will be captured by mobile banking.”

He said all payments, including utility bills, salaries, tuition fees, business and social safety net programmes, will come under mobile banking.

"Bangladesh ranks second in the world in terms of the number of accounts and transaction volume of mobile financial services. We believe, in a couple of months, Bangladesh will be the world leader.”

The MicroSave research is based on 2,490 nationally representative agent interviews, and was carried out between March and April 2014. However, the report said most customers conduct their transactions -- cash in, cash out -- through the agents' accounts, which is illegal.

Customers do not want to open their own accounts, while agents open multiple personal accounts and provide the services.

About 13 percent of agents in Bangladesh reported that they faced fraudulence for sending wrong text messages. "It happens as the agents handle multiple SIM cards to provide the service," said George. There is a need to simplify the 'Know Your Customers' norms in Bangladesh, he said.

The central bank has given permission to 28 banks to launch mobile financial services. Of them, 19 have started operations, according to the Bangladesh Bank website.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments