IMF to review loan conditions

The IMF at the end of this week will review Bangladesh's progress in implementing the conditions tagged with the fifth instalment, or $140 million, of a $1 billion loan under the lender's Extended Credit Facility programme.

If the International Monetary Fund finds the conditions were met satisfactorily, the amount may be released in May, a finance ministry official said.

During the two-week review that starts on Wednesday, the IMF will focus on a VAT automation system, state banks' performances, and the budget for the current and next fiscal years.

The lender has already sent several questions to the government to know about the progress made so far in meeting the conditions, the official said, adding that there will be no obstacle to getting the loan as the conditions are being fulfilled.

The IMF also inquired whether BASIC and four other state banks have complied with the instructions of the central bank under a memorandum of understanding reached by them.

Besides, the lender wanted to know about classified loans, capital adequacy and profitability indicators of the state banks.

The finance ministry official said the financial position of the state banks, except BASIC, has improved significantly. Their classified loans fell by about 9 percentage points to 19 percent in December last year compared to those in September.

The banks saw a surplus capital of Tk 855 crore in December though there was a Tk 9,000 crore shortfall in September.

However, the official said the banks have improved their positions in line with the Basel II requirements, but they will need more capital if Basel III standards are applied.

The state banks have already formulated an internal control and compliance policy to improve their corporate governance under a major IMF condition for the banking sector.

To meet another condition, the finance ministry official said, the banks will draw a detailed action plan for automation within this month.

The government has enacted a new VAT law, which will be enforced from July 2015, in a bid to increase revenue collection.

An official of the National Board Revenue said they have already called for bids to appoint a vendor for purchasing the VAT automation software, and evaluation of the proposals is going on.

To introduce the VAT law by 2015, all sectors will have to be digitised and greater connectivity should be established, another NBR official said. He, however, expressed doubts whether these could be done within the deadline.

Another major condition tagged with ECF loan was about ensuring discipline in the national budget.

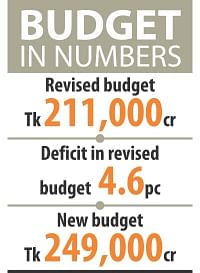

The finance ministry official said, despite pressures from the planning ministry, the finance ministry has not yet agreed to increase allocation in the annual development programme (ADP) to contain budget deficit within the limit. The government plans to keep the deficit unchanged at 4.6 percent in the revised budget.

The amount of borrowing from the banking system will also be kept within the limit set in the original budget.

The official said the size of the revised budget may be brought down to Tk 211,000 crore from the original allocation of Tk 222,000 crore.

He also hinted that the size of the budget for the next fiscal year could be Tk 249,000 crore and the budget deficit will be kept within 5 percent of the allocation.

As the IMF has concern over subsidies, the government plans to bring down such spending on electricity and petroleum products. However, the agriculture sector will not see cuts in subsidy.

The price of electricity has already been hiked but adjustment of petroleum prices will not be required this fiscal year as the prices are already low in the international market, the official said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments