City Bank: front-runner in credit cards

The City Bank has outpaced its rivals in credit card business, thanks to a strong marketing drive with its American Express cards that offered unique and higher lifestyle benefit to users.

Although the sector has long been going through a slow period, City has grown exceptionally -- 25 percent a year, on average, in the last five years -- to take the total number of its credit cards to more than 192,000 at the end of November.

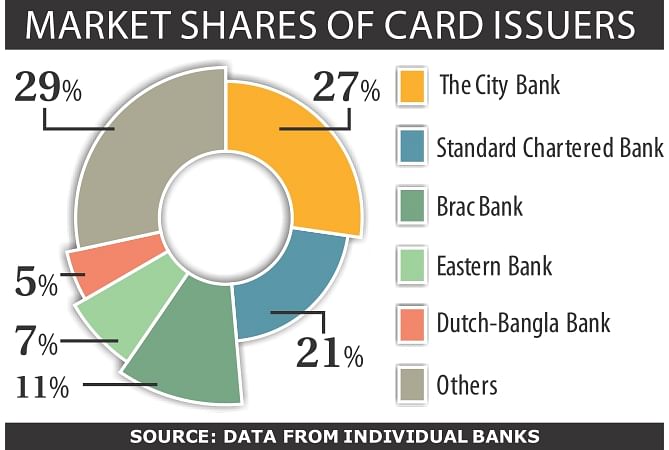

Long-time market leader Standard Chartered Bank has around 150,000 active credit cards, according to data from the bank.

Most banks in the business offer Visa and MasterCard, but only City issues American Express.

“We have made credit cards an integral part of lifestyle,” Mashrur Arefin, deputy managing director of City, told The Daily Star, explaining how they have become the market leader, both in issuing and acquiring of credit cards.

He said City has teamed up with companies from various sectors such as food, travel, entertainment and health care to give its card users a price benefit.

He said Bangladesh is still a "vastly under-tapped market", mainly due to some regulatory barriers related to travel quota and annual card limit.

Market players blame the slower-than-expected growth on a number of issues -- a lack of user-friendly infrastructure, high interest rates and fees, the annual ceiling of Tk 5 lakh per card, mandatory use of tax identification number and extra caution in issuing cards.

Standard Chartered, after acquiring Grindlays Bank's Bangladesh operations, pioneered the product 17 years ago.

Now more than 20 local private banks are in the business. The market covering all banks, including the foreign and local ones, has around 700,000 active credit cards.

Among other major players, Brac Bank has around 77,000 cards, Eastern 50,000 and Dutch-Bangla 35,000.

For the past five years, City has been witnessing 16 percent growth, on average, per year in loans given through credit cards and a 25 percent rise in the number of cards.

All the banks, except City, saw a minimal growth -- around 5 percent on average -- in expanding the business in 2014.

“We had a very insignificant growth in credit card business in the outgoing year,” said Taufiq Hassan, head of cards at Brac Bank. Hassan too was of the view of City's Arefin that the market is lagging behind its potential.

The central bank last year raised the foreign exchange quota limit for an individual traveller to $12,000 a year, which was thought to be a boon both for banks and cardholders.

But bankers said the move failed to bring expected results as the credit card limit for a single user remains unchanged at Tk 5 lakh, which was introduced in 2003.

“This amount ($12,000, which is equivalent to around Tk 936,000) cannot be utilised fully through a single card at one go due to the credit card ceiling at Tk 5 lakh,” Arefin said. “We had approached the central bank to increase the limit, taking into account the changes in exchange and inflation rates since 2003, but that did not work,” said Hassan of Brac Bank.

Abul Kashem Mohammad Shirin, deputy managing director of Dutch-Bangla Bank, and Nazeem A Chowdhury, head of cards at Eastern Bank, identified two barriers to the growth of credit card business -- insufficient points of sale and mandatory use of TIN. “As many shops do not have POS terminals, they cannot accept credit cards,” Shirin said.

Chowdhury said a POS machine costs Tk 30,000-Tk 35,000, which many shop owners think is too high.

He said growth is also stymied by the rule that requires a customer to provide TIN for getting a credit card, as there are only 20 lakh TIN holders in the country. Bankers also blame the slow growth on excessive charges and interest rates.

Credit cards are one of the costliest forms of borrowing that entails an interest rate as high as 30-35 percent a year, in addition to the annual fees of Tk 2,000 to Tk 3,000 per card.

Non-performing loans against credit cards are yet to become a concern for the industry. Dutch-Bangla Bank's NPL remains below 2 percent of its total loans, while it is 6.7 percent and 7 percent for City and Brac Bank respectively. According to bankers, a default rate of less than 8 percent is acceptable.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments