WB recommends carbon tax on fuel

The government should impose carbon tax on petroleum products while fixing their retail prices, in order to reduce carbon emissions, the World Bank has said.

A carbon tax is imposed on the carbon content of fuels that causes carbon dioxide emissions when burned.

A protracted period of low oil prices such as the one the world is currently experiencing is ideal for the introduction of carbon tax, the WB said.

The suggestion was made in a letter to the government last month, in which the Washington-based multilateral lender once again called for initiating a system that adjusts fuel prices with the global market swings.

“The best approach is to let domestic prices follow international prices while using a tax instrument to account for carbon pricing,” said Qimiao Fan, country director of the WB, in a letter to Finance Minister AMA Muhith.

Fan's letter also attached an analysis on pricing petroleum products in Bangladesh, as requested by Muhith during his meeting with Annette Dixon, the WB's vice-president for South Asia, on March 7.

An official of the Economic Relations Division said the government is now examining the proposal of the WB.

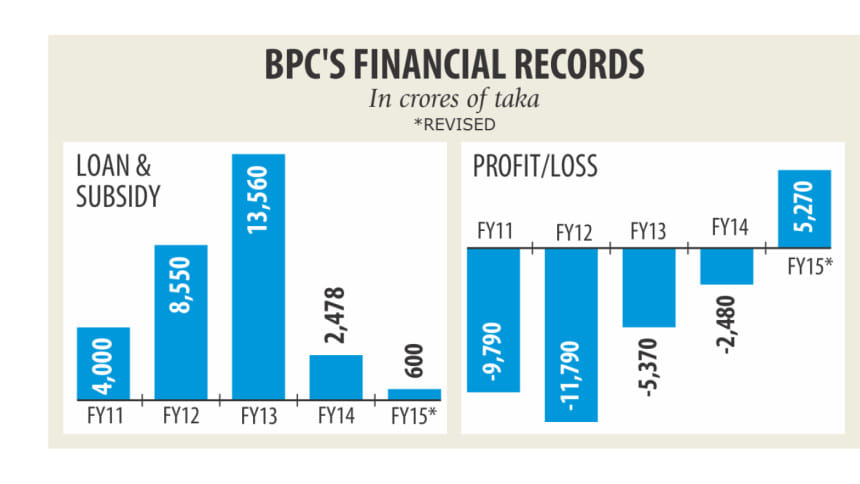

Bangladesh used to sell petroleum products at prices lower than those on the international market, forcing the government to shoulder huge subsidies.

But now that the oil prices have plummeted in the global market, the government is reluctant to make the price adjustments, in order to allow the Bangladesh Petroleum Corporation to recoup the losses it had incurred in the past.

The WB analysis said current macroeconomic conditions in Bangladesh and the low international oil prices provide a historic opportunity to de-regulate domestic oil prices.

“Public resistance to pricing reform is lower when economic growth is relatively high and inflation is low, as is the case in Bangladesh.”

Besides, the subsidised fuel currently encourages high levels of vehicle traffic, which have negative externalities in the form of congestion, higher rates of accidents, road damage and environmental pollution.

The under-pricing also reduces incentives for investment in energy efficiency and renewable energy.

The WB said the best way to rationalise energy prices for Bangladesh is through periodic automatic indexation to reflect changes in the international market and the nominal exchange rate.

But in the long term, the government should aim to fully liberalise pricing for petroleum products.

More liberalised regimes tend to be more robust to the reintroduction of distortionary subsidies than automatic pricing mechanisms, the WB said.

Bangladesh has recently followed a mixture of ad hoc and active regulation.

Several price adjustments during fiscal 2010-11 to 2012-13 led to elimination of subsidies to petrol and octane in Bangladesh.

However, significant subsidies for diesel and kerosene continued until the recent slide in oil prices. Bangladesh has used subsidies for decades as a policy instrument to promote a wide range of social and economic objectives. One rationale for providing energy subsidies is to support access to energy for the poor.

“While there are some elements of truth to this argument, energy subsidies often disproportionately benefit wealthier segments of society, given that they use more energy,” the WB said.

This is true in Bangladesh, where the poor are mostly dependent on traditional bio-mass and have little access to electricity and other public utilities.

Global experience shows the richest 20 percent of the households in the low- and middle-income countries capture six times more in total fuel product subsidies than the poorest 20 percent of households, the multilateral lender said.

Energy subsidies also divert public funds from social programmes and welfare schemes that may be of greater benefit to the poor.

The WB also said the existing petroleum product pricing system is not transparent in areas from imports and refining to transport and distribution. “There is little competition, and the environment is not conducive to attracting private investment.”

In the absence of competition and an adequate pricing system, state-run refinery and marketing companies are in poor financial health, have no incentive for efficiency improvement and provide poor quality of service to consumers.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments