Sales of savings tools continue to climb

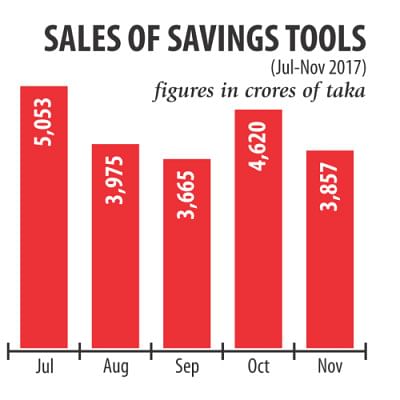

Savers' appetite for high-yielding schemes shows no sign of fading as net sales of savings certificates rose 4.19 percent year-on-year to Tk 21,172.07 crore in the first five months of the fiscal year.

In the July-November period, the government's borrowing through the savings instruments was more than 70 percent of the entire fiscal year's target of Tk 30,150 crore, according to data from the Department of National Savings.

The attraction of the savings tools is their interest rates -- 11.04 to 11.76 percent -- way higher than the 7 to 8 percent offered by banks on fixed deposits.

In fiscal 2016-17, net sales of savings tools hit an all-time high of Tk 52,327 crore, more than 2.5 times higher than the government's target of Tk 19,610 crore.

The trend will continue this year if the government does not slash the rates, said a Bangladesh Bank official.

This form of borrowing is pushing up the government's expenditure. The rate is 2.98 to 8.34 percent when the government borrows from the banking system.

Because of the large sales, the government's net borrowing from the banking sector went into the negative in the first quarter of 2017-18.

The government borrowed Tk 2,132.3 crore and repaid Tk 5,270.2 crore, taking its net borrowing to Tk 3,137.90 crore in the negative.

The BB official, however, said commercial banks had recently increased the rate of interest on their deposit products because of a shortage of liquid funds. Some banks have also adopted an "aggressive lending" policy causing much concern to the central bank as such trends left an adverse impact on their liquidity base, he said.

In November, private sector credit growth stood at 19.06 percent, far beyond the target of 16.2 percent set by the central bank for the first half of the fiscal year.

Against this backdrop, the banks will increase the rate on their deposit products in the months to come to alleviate the liquidity crunch, the official said.

The sales of savings tools may decrease when the rate on banks' products will go up, the central banker said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments