Private sector credit growth beats target

Private sector credit growth has surpassed the target set in the central bank's monetary policy -- three months ahead of the end of the fiscal year -- thanks to low interest rates and less borrowing by the government.

The growth was 15.16 percent in March, which is 0.16 percentage point higher than the target, according to central bank statistics.

The BB in its Monetary Policy Statement (MPS) set the private sector credit growth at 15 percent year-on-year by June 30 this year.

The credit growth also rose over the same period last year; on March 15 last year, the credit growth was 13.6 percent.

The central bank said the credit growth was below 14 percent last fiscal year, while the country's economic growth was 6.5 percent.

“A provision of 14.8 percent private credit growth appears to be adequate to support close to 7 percent output growth for the current fiscal year,” the central bank said in the MPS.

The growth in gross domestic product would be 7.05 percent this fiscal year, according to provisional estimates by Bangladesh Bureau of Statistics.

The central bank in the MPS also cut the policy rate by 50 basis points and gave the banks a signal to lower the rate of interest and increase the amount of investment.

“Based on commendable macro-stability, it is the high time to stimulate investment and thus growth where political calm beckons to use improved condition in the market confidence,” the MPS said.

Abdus Salam, managing director of Janata Bank, said interest rates on loans have decreased much and borrowers are now more interested in taking loans.

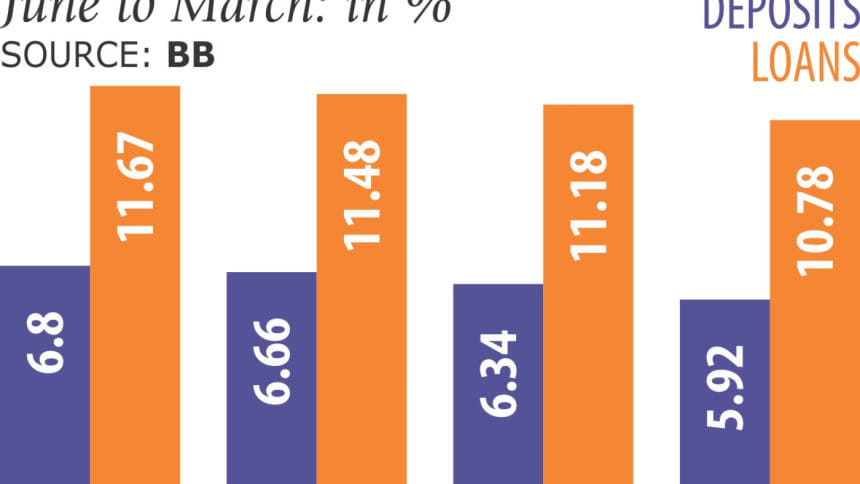

The average interest rate on loans was 10.78 percent in March, down from 11.93 percent during the same month last fiscal year.

Salam said auctions of the government's treasury bills and bonds are taking place less frequently, which compelled banks to use their excess liquidity for giving higher amounts of loans.

Nurul Amin, managing director of Meghna Bank, said credit growth rose mainly due to the progress in work of mega projects, including the Padma bridge, as contractor firms are taking more loans.

Besides, operators in the services sector such as hotels, restaurants and transport companies are taking loans, though the scenario in large industries is not so encouraging.

Salam of Janata Bank said, “We have shifted our focus in giving loans. We are now putting emphasis on farm and SME loans.”

He said they are going to divert 25 percent of their loanable funds to small initiatives in rural areas.

Agriculture loan disbursement during July-March of the current fiscal year increased 14.34 percent against last fiscal year's growth of 1.38 percent, according to BB data.

Non-farm rural credit rose 18.76 percent in the first nine months of the current year, which dropped 30.16 percent during the same period last year.

In the first six months of the current fiscal year, large-scale industrial loans fell 5.46 percent.

However, term loans for small and cottage industries increased 63 percent during the same period.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments