Private credit growth continues ascent

Private sector credit growth is continuing with its ascent, helped in part by the higher import of food grains and capital machinery.

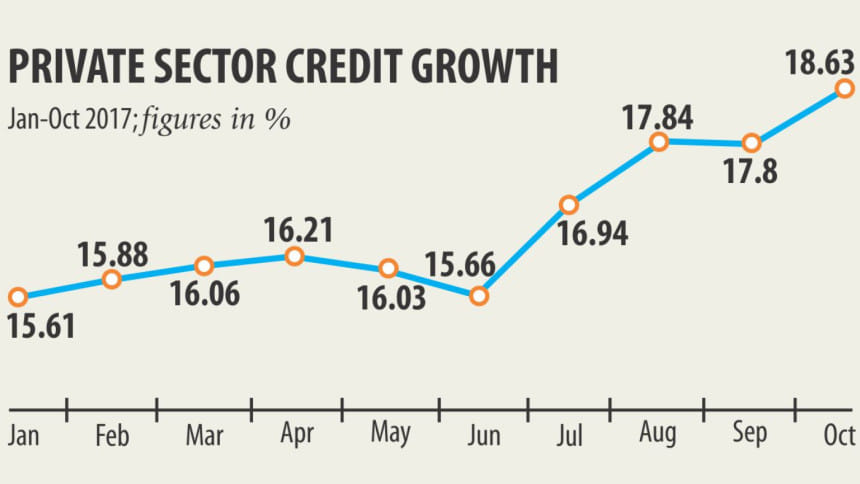

In October, private sector credit growth stood at 18.63 percent, which is way higher than the target of 16.2 percent set for the first half of the fiscal year, according to data from the Bangladesh Bank.

The last time the credit growth was higher than this was back in March 2012, when it stood at 19.5 percent.

“The high credit growth is unusual,” said a senior BB official, adding that banks are repeatedly being advised to be cautious about their lending.

In July, private sector credit growth stood at 16.94 percent, exceeding the monetary target of 16.2 percent for the first half of 2017.

The growth slowed slightly to 17.8 percent in September from 17.84 percent in August.

The increase in credit growth was due to deferred letters of credit payment mostly for food grains and capital machinery, said MA Halim Chowdhury, managing director of Pubali Bank.

The LC opening value against food grains trebled to $1.55 billion in July-September of the year. During the period, LC opening for capital machinery soared 27.4 percent to $1.32 billion.

The higher credit growth will put pressure on the lending rate very soon, with some banks already revising their interest rates upwards, he added.

The government's development works and establishment of power plants bumped up the credit demand, said Md Arfan Ali, managing director of Bank Asia.

Banks are lending to power plant projects following the government's call for providing Tk 20,000 crore to the power sector.

Ali echoed Chowdhury's view that the rising credit demand will eventually push up the lending rates.

Earlier in July, the government formed a committee to go through the Bank Company Act 1991 to check if there is any provision that bars banks from providing large loans to the power sector.

The move was taken after the power division requested banks to channel Tk 20,000 crore into the power sector by December.

At present, banks can provide loans of up to 25 percent of their capital to a single borrower. For some banks it would not be possible to lend at a scale needed by the power sector companies without exceeding the limit.

Public sector credit growth, on the other hand, has remained in the negative owing to bumper sales of savings instruments. It stood at -12.13 percent, which is way off the monetary ceiling of 3.80 percent for December.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments