Panel to probe Doreen Power's abnormal share price spike

Bangladesh Securities and Exchange Commission has formed a two-member panel to investigate an unusual price hike in shares of Doreen Power Generations and Systems.

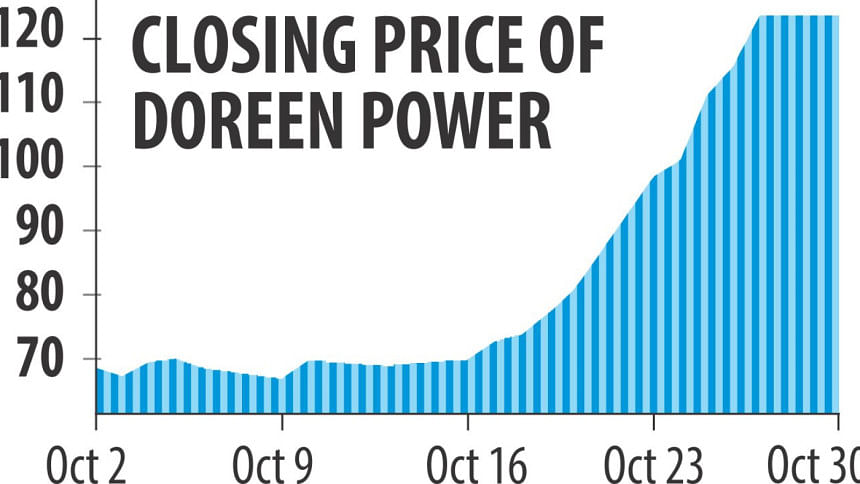

The regulator made the move at a meeting yesterday after prices of Doreen Power's shares almost doubled in just two weeks.

“We found some unusual trends in trading of Doreen Power's shares -- our surveillance department also marked alerts in its monitoring system. So, the commission decided to carry out a detail investigation,” said Saifur Rahman, spokesman and an executive director of BSEC.

The price of each Doreen Power share was Tk 70 on the Dhaka Stock Exchange on October 16, but it rose to Tk 123 at the close of yesterday's trade, showing a 75 percent hike.

The stockmarket watchdog asked the panel, which comprises BSEC's deputy directors Mohammad Shamsur Rahman and Mustari Jahan, to file the probe report with the commission in 30 working days.

The power generation company was listed on the stockmarket in April this year. It has three plants that generate and supply 66 megawatt to Bangladesh Power Development Board and Rural Electrification Board under two agreements for a period of 15 years.

Its net profit in 2015 was Tk 13.49 crore, down from Tk 15.5 crore a year ago.

In another development, the BSEC approved the prospectus of a Tk 100-crore closed-end mutual fund sponsored by Islami Bank.

A mutual fund is a professionally managed collective investment scheme that pools money from many investors and invests in stocks, bonds and short-term money market instruments.

Of the total value, Islami Bank has already subscribed units worth Tk 50 crore as the sponsor, while Tk 25 crore has been raised through pre-IPO private placement.

The remaining Tk 25 crore will be raised from investors through an initial public offering, the stockmarket regulator said in a statement.

Strategic Equity Management is the issue manager of the 10-year fund styled 'SEML IBBL Shariah Fund', while the Investment Corporation Bangladesh is the trustee and custodian.

Presently, there are 34 mutual funds listed on the premier bourse, accounting for only about 1 percent of total market capitalisation.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments