Turnover tumbles as investors gear up for Robi IPO

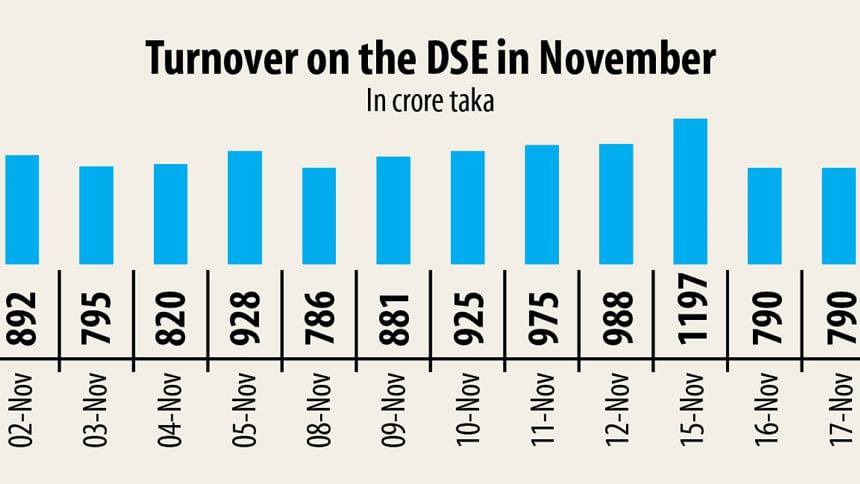

Turnover on the Dhaka Stock Exchange plunged 31 per cent to Tk 544 crore because of the thin participation of institutional and general stock investors as they are gearing up for Robi's initial public offering.

This is the lowest turnover, one of the key indicators of the market, in the last three and a half months.

Many institutional and general investors were in the selling mood. So, the index dropped along with the turnover, said a stockbroker.

The DSEX, the benchmark index of the bourse, fell 17.97 points, or 0.36 per cent, to 4,887.12.

Investors are selling shares to set aside funds for the subscription of Robi Axiata, the stockbroker said.

The subscription of the biggest IPO in the history of Bangladesh began on Tuesday and will continue until November 23. The operator would raise Tk 523 crore.

Though the index was plunging, junk stocks rose. Most of the Z category stocks, the companies that are either not providing dividend or are closed, advanced.

Meghnapet Industries topped the gainers' chart with an increase of 10 per cent. Dulamia Cotton, United Airways, and Jute Spinners were also in the list.

The junk stocks are rising because of a rumour that gambling is taking place involving the stocks, said Abdul Haque, an investor.

The general investors should not heed to the rumour. But, as the stocks are rising,

investors are rushing towards them, he said.

"The stocks of the sound companies are almost immobile," he added.

Well-performing stocks are always good for investment despite lower return, said Mir Ariful Islam, a stock market analyst.

Investment decisions based on rumours may wipe out an investor's capital abruptly, he said. But this is not seen in case of well-performing stocks.

So, institutional investors make money at the end of the year. In contrast, many individual investors fail to count any profits, said Islam, also the head of research of Prime Finance Asset Management Company.

Beximco Pharmaceuticals was the most traded stocks on the DSE yesterday, with its securities worth Tk 43 crore changing hands, followed by Square Pharmaceuticals, Brac Bank, Quasem Industries, and Associated Oxygen.

Of the stocks, 79 advanced, 174 declined, and 82 remained unchanged.

Genex Infosys lost the most giving up 9.15 per cent, followed by Hamid Fabrics, Familytex Bangladesh, SEML IBBL Shariah Fund, and Mobil Jamuna.

Shares on the Chattogram Stock Exchange also fell. The CSEX, the benchmark index of the port city bourse, dropped 37.41 points, or 0.44 per cent, to 8,421.96.

Of the shares traded, 47 rose, 141 declined, and 50 remained unchanged.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments