Stock rally carries on

The stock market continued to rise for a sixth day yesterday, sans the two-day weekend, while turnover almost doubled thanks to an increase in the participation of investors despite a deterioration of the coronavirus pandemic.

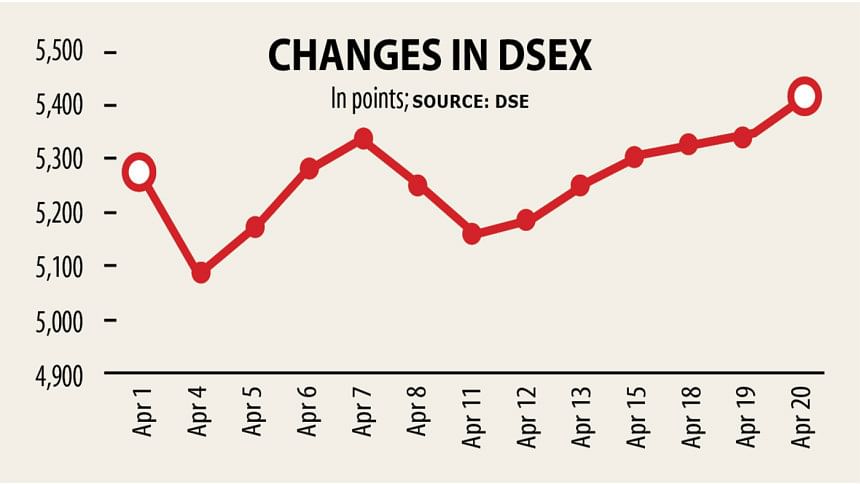

The DSEX, the benchmark index of Dhaka Stock Exchange (DSE), surged by 71 points, or 1.34 per cent, to stand at 5,421.78 yesterday.

Turnover, another important indicator of the market, rose 87 per cent to Tk 1,299 crore.

The scope to make easy money is the most important and biggest reason for the Bangladesh market rally, which is also common in stock markets around the world, said Md Moniruzzaman, managing director of IDLC Investments.

Banks' interest rate is now very low, so high net-worth individuals are viewing the stock market as a better investment option rather than keeping deposits with banks, he said.

Another reason is that the banks, ports and industries are open during the ongoing lockdown, so the impact on businesses will not be at that much of a big extent this year, said the merchant bank official.

Though consumption is being impacted, it will hopefully bounce back after the lockdown, he said.

"So, people are buying shares," he explained.

Mohammad Rahmat Pasha, CEO of UCB Capital Management, one of the market's top stock brokers, said the index was rising as it had taken a steep plunge just a few days earlier.

"This is normal in the stock market," he said.

The rising trend in the last couple of days gave a boost to retail investors' confidence, so they are buying shares, he said, adding this was common nature for retailers.

Last year, they sold shares at a very low price when the market was falling before the two month-long general leave as they saw a bearish trend for a few days, Pasha clarified.

Some institutional investors made investments in the last few days but most of them are now waiting to see how the situation turns out, he said.

They believe that business was being hampered by the current lockdown, so profits of listed companies will be impacted, he said.

On the bright side for investors, manufacturing companies will disclose their financial performance of the past nine months, so they are buying shares considering their potentials, he said.

Responding to a question, the UCB Capital CEO said foreign investors were still in the mood to go for sales as the Covid-19 infection rate was rising in Bangladesh. On the other hand, the world market is rallying, so their preference was towards other markets, he added.

Many investors regained confidence seeing the market rally in the last few days, said stock investor Abdullah Quraishi.

Moreover, increased block trading prompted them to buy shares, he said, adding that the trade was mostly carried out by big investors.

Block market trading amounted to Tk 402 crore yesterday, shows DSE data.

If institutional investors join at this stage, the market will reach a higher level, he added.

Eastern Insurance Company topped the gainers' list, rising 9.93 per cent, followed by Miracle Industries, Anwar Galvanizing, Usmania Glass Sheet Factory and Golden Son.

Stocks of Beximco were traded the highest, worth Tk 147 crore, followed by Beximco Pharmaceuticals, LankaBangla Finance, Robi Axiata and BD Finance.

Provati Insurance Company shed the most, dropping 6.3 per cent, followed by Continental Insurance, Central Insurance, Crystal Insurance Company and Sonar Bangla Insurance.

At the DSE, 193 stocks advanced, 98 declined and 63 remained unchanged.

Chittagong Stock Exchange also remained in an upward trend. The CASPI, the general index of the port city bourse, rose 214 points, or 1.38 per cent, to stand at 15,685.

Among 237 stocks to witness trade, 133 rose, 76 fell and 28 remained unchanged, shows CSE data.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments