Something fishy about Fine Foods’ quarterly reports

The fall in profit of Fine Foods in the last quarter of fiscal year 2019-20 raises eyebrows of the investors and analysts as the listed aquaculture and agro-based company registered its highest ever earnings in the previous three quarters.

Earnings per share (EPS) of the producer of various fish and meat products stood at Tk 0.18 at the end of fiscal 2019-20 in June -- a steep fall from Tk 1.44 three months ago.

"Fishing has not been banned amid the ongoing pandemic and people did not suddenly stop eating either. So why should the company's earning witness such a plunge?" a stock broker questioned.

However, Fine Foods' sudden surge in profits between the first and third quarters was also suspicious since it showed considerably higher quarterly earnings compared to previous records.

Besides, quarterly reports were not audited, he added. The company's EPS were Tk 0.81, Tk 0.64, Tk 0.07, and Tk 0.24 in four fiscal years to 2018-19 respectively.

In the last fiscal year, its first quarter EPS stood at Tk 0.34 while it rose to Tk 0.50 in the second quarter and finally hit Tk 0.60 in the third quarter.

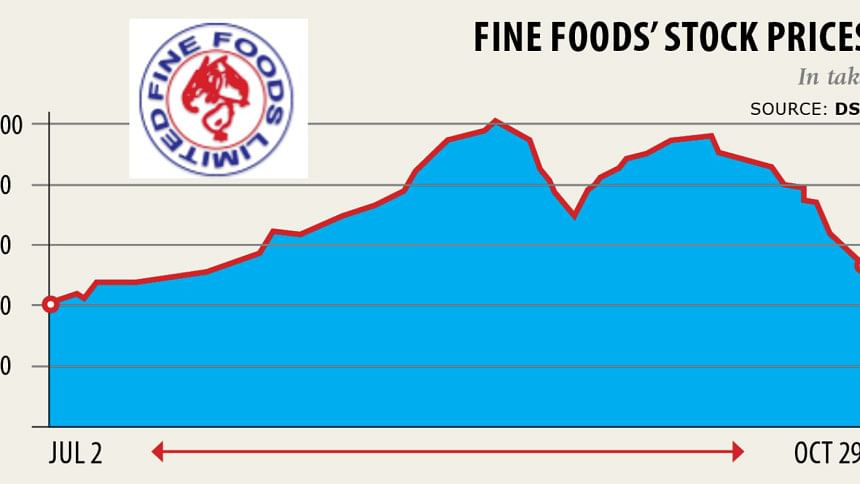

Fine Foods' share price also jumped alongside its increased earnings but the company did not explain the reason behind such a rise and subsequent fall in EPS even though it was mandatory as per the securities rules, the broker said.

For a company's earnings to fall to such an extent is not normal, a merchant banker said on condition of anonymity.

Fine Foods recorded over Tk 2 crore in profits up till the third quarter but this fell to Tk 26 lakh by the end of the year, according to the quarterly reports.

"This is fishy," he said, adding that the Bangladesh Securities and Exchange Commission (BSEC) should investigate whether the fluctuation in earnings is actually genuine.

With paid-up capital of Tk 13.97 crore, Fine Foods witnessed a sudden increase in its share price last year even though it has provided 2 to 3 per cent dividends since 2015-16.

In July, Fine Foods' stock was traded at Tk 40, which almost tripled to Tk 101 before last September.

Only 5.09 per cent of the company's shares are held by its directors. Its managing director holds a 5.05 per cent stake while the chairman holds 0.01 per cent of the shares, data from the Dhaka Stock Exchange shows.

An auditor of the company also provided a qualified opinion on its financial report for not following accounting standards.

For 2019-20, Fine Foods announced 1 per cent cash dividend. The company's main fish related project is located in Kishoreganj while another one is in Mymensingh.

Investors purchase stocks after reviewing the company's quarterly earnings and so these reports should be accurate, said Akbor Ali, a stock investor.

Since quarterly reports are not audited, some companies deliberately change their earnings.

"It seems this might be the case for Fine Foods. So the market regulator should investigate it," Ali added.

It is difficult to understand a company's motives by their quarterly reports alone as these reports are not audited, said a senior official of the BSEC.

"We will try to investigate Fine Foods' business reality for the year, he added.

Md Sohel Hossain, company secretary of Fine Foods, answered The Daily Star's call for a comment but declined to say anything on the matter at that moment.

However, Hossain did respond to any follow-up attempts to make contact by the time this report was filed.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments