Recovery from loan write-off plummets

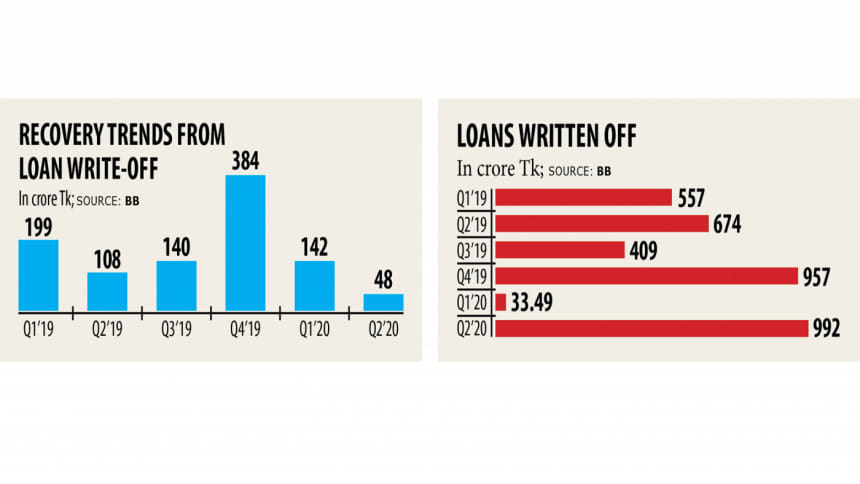

Recovery from loan write-offs plunged to at least a 66-month low in the second quarter of 2020 as banks faced troubles in realising the delinquent loans because of the countrywide shutdown.

In contrast, lenders wrote off a large amount of loans between April and June to clean their balance sheets.

Banks collectively recouped Tk 48 crore from their written-off loans in the April to June quarter, down 66 per cent from three months ago and 87 per cent from a year earlier, according to data from the central bank.

This is the slowest recovery from the written-off loans since 2015. Loan recovery data before 2015 was not available.

Banks wrote off Tk 992 crore in the second quarter, the highest since January 2019. Loans amounting to Tk 2,057 crore were written off in the last quarter of 2018.

The write-off is a tool that allows banks to clean their balance sheet by removing bad assets. Lenders have to keep 100 per cent provisioning against the delinquent loans.

There is no realistic prospect of recovering them and the majority of loans are now owned by the habitual defaulters. These loans are shifted to off-balance sheet records.

The module of loan write-off has become a better tool than the loan rescheduling as some defaulters now frequently regularise their non-performing loans by taking advantage of the relaxed facility, experts said.

In many cases, banks do not keep 100 per cent provisioning against the rescheduled loans, putting an adverse impact on the financial health of lenders, they said.

"Banks will have to sacrifice profits to write off defaulted loans as they have to maintain a large amount of provisioning," said Emranul Huq, managing director of Dhaka Bank.

But, the recovery from such loans has created a worrisome situation for the banking sector as a major portion of the written-off loans is owned by the habitual defaulters, he said.

The recovery from all types of loans declined in the second quarter due to the shutdown put in place to contain the spread of the coronavirus pandemic.

Huq, however, said loan recovery is improving in the third quarter as the economy is picking up again.

"Realising written-off loans is usually tough and the trend has worsened in the recent months due to the business slowdown," said Syed Mahbubur Rahman, managing director of Mutual Trust Bank.

The judicial process was hampered in the second quarter due to the pandemic. This has also slowed down the recovery, he said.

Banks have to file lawsuits against the defaulters before writing off loans.

"A good amount of the written-off loans were recovered as per the verdict given by the courts," said Rahman, also a former chairman of the Association of Bankers, Bangladesh, an organisation of the top executives of banks.

As of June, the banking sector's total written-off loans stood at Tk 55,804 crore, up 2.5 per cent from a year earlier.

Banks have failed to realise 77.54 per cent of the total written-off loans since January 2003, when the central bank introduced the policy.

Unrealised delinquent loans stand at Tk 43,272 crore as of June.

Despite keeping 100 per cent provisioning, the write-off is not a solution to tackle the defaulted loans, a central bank official said.

If defaulted loans can be checked, the written-off loans will go down automatically, he said.

Non-performing loans totalled Tk 96,116.65 crore as of June, up 1.91 per cent six months ago and 14.50 per cent one year earlier.

The relaxed rescheduling facility offered by the central bank last year helped banks bring down their NPLs significantly.

The policy allowed defaulters to reschedule their classified loans with a down payment of 2 per cent of the outstanding amount instead of the existing 10-50 per cent.

Under the relaxed policy, banks rescheduled defaulted loans of more than Tk 50,000 crore last year.

The central bank has also granted a moratorium facility to borrowers for this year so that they can tackle the ongoing economic hardship.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments