Investors frustrated over Ring Shine Textile’s factory closure

Investors of Ring Shine Textile have been left shocked by the company's decision to shut down its factory at the Dhaka Export Processing Zone in Savar for a month.

Citing the economic turmoil brought about by the ongoing coronavirus pandemic, the export-based garment maker informed the Dhaka Stock Exchange (DSE) yesterday, declaring that its factory would be laid off until October 25.

The move comes as a result of the Covid-19 fallout, declining orders from foreign buyers and a shortage of imported raw materials, Ring ShineTextile said in its statement, adding that the decision was taken in line with section-11 of the Bangladesh EPZ Labour Law, 2019.

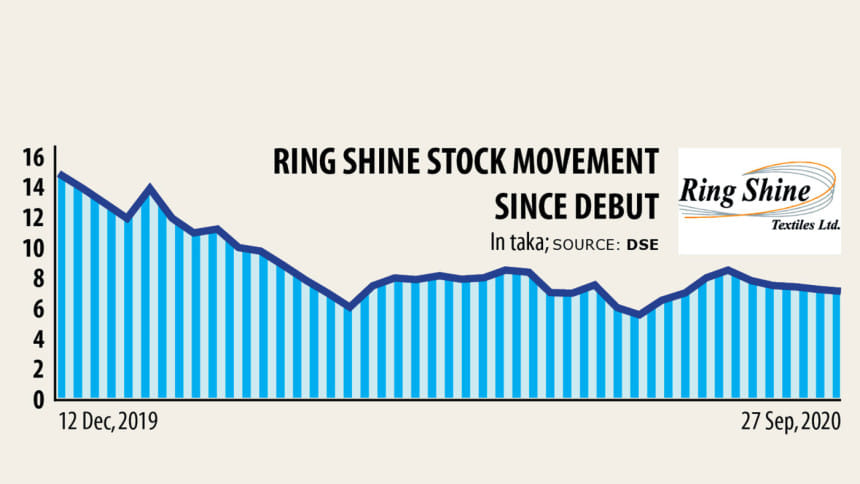

Soon after the news broke, the company's stocks plunged 8.97 per cent to Tk 7.10 on the DSE's trading board, according to data from the country's premier bourse.

Ring Shine Textile started to dishearten its investors from the very beginning, when it was first listed in 2019, said Abduz Zoha, a stock investor.

Having raised Tk 150 crore from the capital market, the garment maker's stock price ballooned to Tk 15 per share on debut but following a barrage of rumours, prices soon began to decline.

Within a month of being listed, Ring Shine Textile was shrouded in scandal as rumours made people believe that the company's foreign staff, including its directors, were abandoning their posts and leaving the country for good.

This triggered a downward slide in stock prices and as a result, Ring Shine Textile's profits dropped by over 11 per cent to Tk 49.91 crore in 2018-19.

At the time, the textile maker did not disburse any cash dividend, but issued 15 per cent stock dividend.

This only led to an increase in the market's share supply, forcing the stock price to plummet again, Zoha said.

In light of the situation, a key sponsor of Ring Shine Textile sold his shared within just two-and-a-half months of the company's listing.

This came as yet another blow for general investors, who have seen the value of their holdings fall by the day.

Sung Wey Min, the owner of Universe Knitting Garments and managing director of Ring Shine Textile, is the sponsor in question that sold his 36.86 lakh shares with the textile maker.

As if that was not bad enough, this factory layoff has piled even more pressure on the company's stocks, Zoha added.

According to market analysts, when a company's sponsor sells his or her shares just after being listed, it gives a bad signal to general shareholders.

A sponsor can sell his or her shares as they wish but when they do so under a stock's face value, then it raises questions about the company's potential, they added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments