Govt belt-tightening bears fruit as revenue expenditure drops

The economy is apparently sailing safely through the turbulent times amid additional fund allocated to tackle the coronavirus crisis and anaemic growth of tax collection as revenue expenditure fell 3.66 per cent in the first quarter.

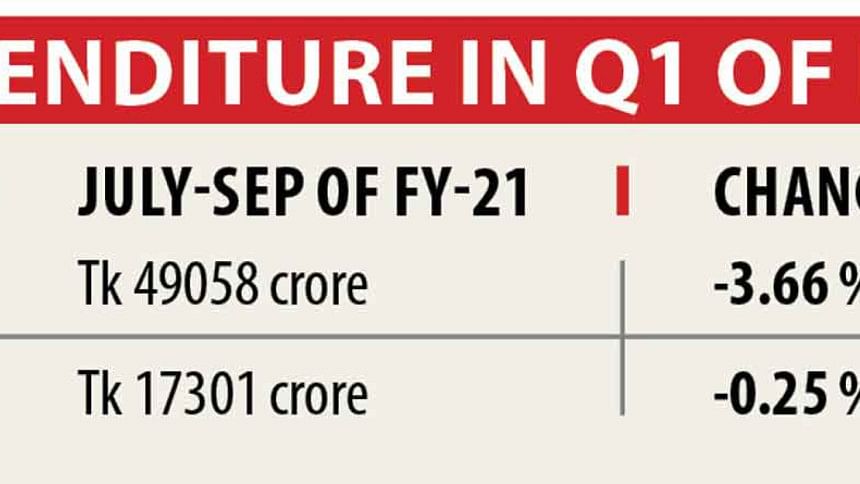

The government revenue budget expenditure in the July-September period was Tk 49,058 crore, which was Tk 50,922 crore during the same period last fiscal year.

The fall in government spending comes as it took to categorising projects based on priority alongside austerity measures due to the pandemic.

For coronavirus, the government ramped up spending in the health sector. It widened social safety net programmes to help people whose earnings have drastically reduced or reached next to nothing because of an avalanche of lay-offs in every industry.

Despite this additional spending, the public expenses decreased as it introduced several austerity measures to tackle the economic downturn. In July, the government decided against purchasing new vehicles under all operating and development expenses for the rest of 2020 as part of the austerity measures in the face of falling revenues due to the coronavirus pandemic.

The government also curtailed 50 per cent of budgetary allocation for expenses of tours at home and abroad of officials and banned all routine travels in late July.

The move applied to all travel expenses under the operating and development budget of the government, semi-government, autonomous and other agencies.

The government has allocated Tk 2,200 crore to pay for expenses of tours abroad for its officials in FY21.

The lion's share of this amount is not being spent as tours have been limited due to the pandemic, which prompted the suspension of global events and seminars and flight cancellations.

Under normal circumstances, ministers or top officials of different ministries or departments go abroad with large entourages to attend seminars or other programmes, which are all now taking place through digital platforms.

"The government prioritised sectors such as health and social safety and undertook some austerity measures so that revenue expenditure decreased this year," said an official of the finance ministry.

"Apart from the decrease in foreign tours, the lower spending is also owing to cancellation of many local seminars, which turned to webinars and that is too at meagre costs," he said.

The development expenditure fell 0.25 per cent during the first three months of the fiscal year as the government halted low-priority project financing.

From July to September, the development expenditure stood at Tk 17,301 crore, down from Tk 17,344 crore during the same period last fiscal year.

It came as the government, during the initial periods of the pandemic, decided to ensure the best use of limited resources and make funds available for the priority sectors.

During that time, it decided to put a hold to the implementation of low-priority development projects involving Tk 40,000 crore.

In a palpable sign of an economic turnaround from the pandemic fallouts, the National Board of Revenue's collection in the first four months of this fiscal -- July to October -- grew 3.61 per cent to Tk 68,128 crore, which was Tk 65,754 crore during the same period last year.

The government's bank borrowing plunged 44.53 per cent to Tk 15,925 crore in the first three months of this fiscal year, down from Tk 28,710 crore of the same period last year.

The bank borrowing decreased because of an increase in government borrowing from saving instruments and reduced public expenditure, according to an official of the finance ministry.

Zahid Hussain, a former lead economist at the World Bank's Dhaka office, said the year-on-year reduction in operating expenditure in the first quarter presumably resulted from the implementation of the austerity measures announced at the beginning of the fiscal year.

"Expenditures of the ADP has been flat, hopefully reflecting restraint on fund release for low priority projects. The reduction in total expenditures has helped keep government bank borrowing in check despite anaemic growth in revenue collection," he said.

Hussain said the first quarter's outcomes augur well to face the pressures arising from the resurgence of the virus all over the world, including Bangladesh.

There will be a rise in demand for subsidies and transfers as businesses and employment struggle to recover from the economic fallout of the raging virus, he said.

Small businesses and workers in the informal sector have been hit very hard, and they were the ones who have remained largely excluded from the support packages due to difficulties in reaching them.

Better targeting of expenditures on social protection and grant financing from the budget for cottage, micro and small enterprises (CMSE) delivered through institutions that know how to reach them may help overcome the implementation deficiencies of the announced financial packages, said Hussain.

"Targeted fiscal stimulus will help keep the CMSEs afloat and protect the livelihoods of poor and vulnerable households. It will also stimulate the currently depressed aggregate demand and thus help restart the recovery."

The recovery may stumble as a result of the resurgence of the virus and the inability to deliver assistance to the vast majority of low-income families and informal enterprises, added Hussain.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments