Directors of 28 listed firms fail to comply with minimum shareholding rule

The directors of 28 listed companies have failed to hold at least 30 per cent shares of their companies collectively within the November 30 deadline set by the regulator.

Now, their boards will be restructured as per a decision of the Bangladesh Securities and Exchange Commission (BSEC).

On November 25, the regulator decided to restructure the boards of the companies that fail to hold at least 30 per cent shares of their firms collectively by November 30.

In 2011, the regulator ordered sponsors and directors to hold a minimum of 2 per cent shares of their company individually and 30 per cent jointly.

All the directors did not follow it despite repeated orders from the commission. The regulator had fixed October 27 as the deadline to fulfil the collective minimum shareholding requirement and later extended it by a month.

The directors of 43 companies had to meet the minimum shareholding condition by the deadline, which expired on Monday. Of them, the directors of 15 companies were able to meet the criteria. The companies include Maksons Spinning, Meghna Life Insurance, Metro Spinning, Northern Islami Insurance, Beximco Ltd, Beximco Pharmaceuticals and City Bank.

Olympic Industries, Tallo Spinning, Active Fine Chemicals, Aftab Automobiles, Apex Footwear and Agni Systems are among the companies whose directors have failed to hold the minimum shares collectively, according to a document of the BSEC.

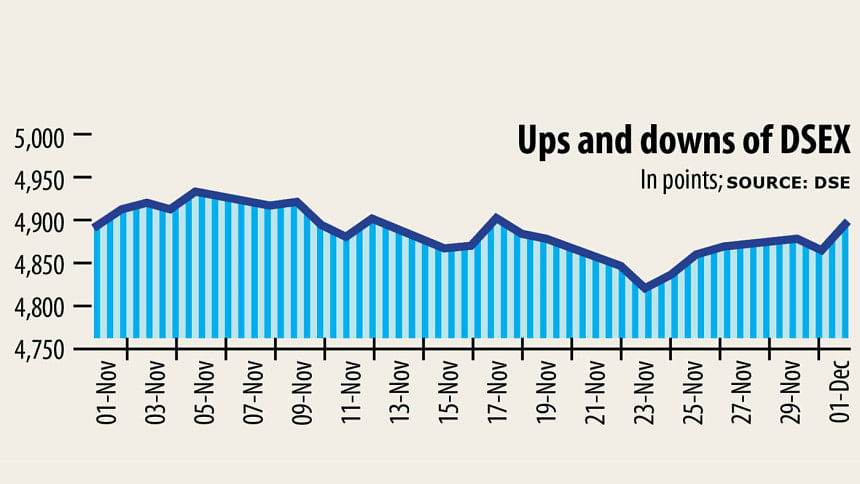

The stock market edged up yesterday thanks to a rise in demands for shares of banking and non-banking financial institutions (NBFIs).

The DSEX, the benchmark index of the Dhaka Stock Exchange, rose 37.11 points, or 0.76 per cent, to close the day at 4,903.95.

Investors went after the stocks, as the financial institutions have seen good profits until September and would announce dividends at the end of December, said Mohammed Rahmat Pasha, managing director and CEO of UCB Capital Management.

If banks take the policy support of the central bank, their profits will be higher than the previous year, he pointed out.

On the other hand, some funds that were stuck to several initial public offerings have recently become free for use. As a result, institutional investors are pouring money now, he added.

No banking stock experienced a price drop yesterday as 26 out of 30 listed banks rose and four remained unchanged.

Out of the 23 listed NBFIs, 17 advanced, three fell and the rest three ended the day without any change, according to DSE data.

Mostly, changes in banking shares leave an impact on the stock market because of their higher contribution to the market capitalisation. Banks' market capitalisation is 16.84 per cent where NBFIs contribution is around 5 per cent.

Turnover, another important indicator of the stock market, dropped 17 per cent to Tk 663 crore.

Delta Spinners topped the gainers' list advancing 10 per cent, followed by Aamra Networks, Agni Systems, National Feed Mill, and Hamid Fabrics. Beximco Pharmaceuticals was the most traded stock with shares worth Tk 31.9 crore changing hands, followed by Pragati Insurance, IFIC, Beximco Ltd and Aamra Networks.

Of the 341 securities, 149 advanced, 92 declined and 109 remained unchanged.

United Power Generation declined the most as it lost 12 per cent followed by Tallu Spinning, Savar Refractories, Bangladesh National Insurance Company and Familytex BD.

The Chattogram Stock Exchange also witnessed a rising trend. The CSEX, the prime index of the port city bourse, rose 59 points, or 0.75 per cent, to 8,486.

Out of the total 242 companies' stocks, 106 rose, 71 fell and 66 remained the same.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments