Deadline extended for disbursing stimulus funds for farm sector

Bangladesh Bank yesterday extended the deadline to disburse the Tk 5,000-crore stimulus package for entrepreneurs in the farm sector by three months following lacklustre lending.

When the package was announced in April, banks were asked to disburse the fund by September 30. But they have shown a poor performance, prompting the central bank to extend the timeframe.

Now, lenders will have to fulfil their target by December 31, according to a central bank notice issued yesterday.

Forty-three banks have so far signed participation agreements with the central bank to disburse loans from the refinance scheme dedicated to reviving the agriculture sector.

Of them, 17 banks disbursed loans below Tk 1 crore, an unwelcome development as the government looks to prompt quick recovery from the economic fallout of Covid-19.

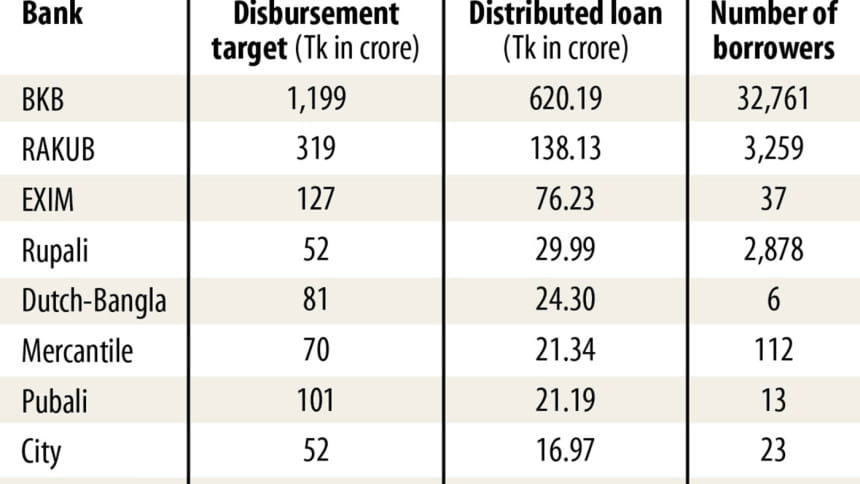

The banks gave out a total of Tk 1,114.16 crore as of August, which is 22.28 per cent of the package, data from the central bank showed. A total of 46,815 clients have so far received the fund to make their businesses vibrant.

The latest flood and the slow recovery have discouraged businesses to take out loans, a central banker said. Besides, banks are yet to take proper initiatives to accelerate disbursements.

Bangladesh Bank has repeatedly asked the country's lenders to expedite disbursements but they did not pay any heed.

"Close monitoring by senior officials of banks would be needed to speed up the disbursement," said Md Ali Hossain Prodhania, managing director of Bangladesh Krishi Bank, which disbursed the highest amount among all lenders.

Krishi Bank disbursed Tk 800 crore out of the Tk 1,190 crore target as of September.

Banks can disburse large loans among a small number of borrowers to attain the target but it can't do the same in case of farm loan, said Tariqul Islam Chowdhury, managing director of South Bangla Agriculture and Commerce Bank.

"We are giving loans to farm borrowers. Some borrowers are taking loans in the range of Tk 2 lakh to Tk 5 lakh. So, it would take a large number of borrowers to reach the target.

"Every single proposal has to be approved by the board, so it takes time," he said.

Chowdhury said bankers were reluctant in the past to disburse farm loans because of lower interest rates. Now, all loans carry the equal 9 per cent interest rate after the central bank capped the lending rate on April 1.

SBAC has been given a farm loan disbursement target of Tk 11 crore.

The tenure for the loans is 18 months, including a grace period of six months at both banks and clients' ends. Banks will borrow from the refinancing scheme at 1 per cent interest rate and lend at 4 per cent.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments