Current account posts $3.53b surplus amid downturn

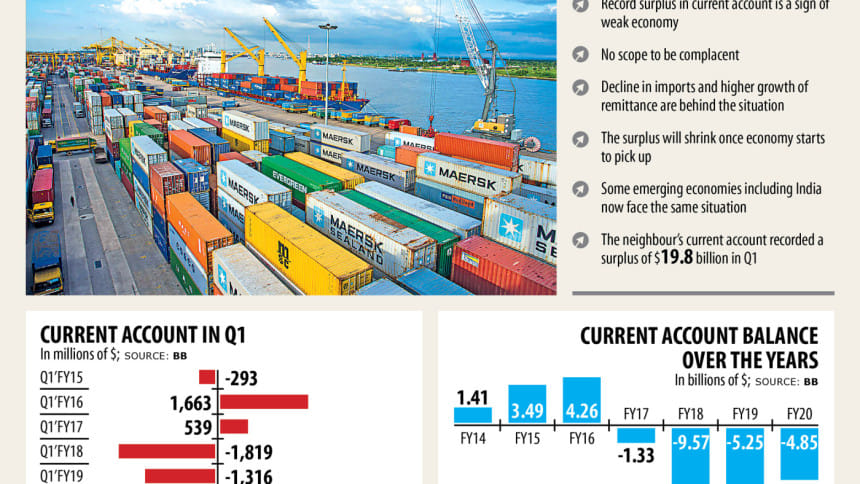

The country's current account balance posted a surplus of $3.53 billion in the first quarter of the fiscal year on the back of a sharp decline in the trade deficit.

This contrasts to a deficit of $715 million in the same quarter a year ago, according to data from the central bank.

The first quarter's current account balance is the highest in the same quarter in the last six years. The current account data before fiscal 2014-15 are not available on the central bank's website.

The current account of the balance of payments is a record of a country's international transactions with the rest of the world. It includes all the transactions (other than those in financial items) that involve economic values and occur between resident and non-resident entities.

The upward trend of the current account balance is a good sign, but there is no scope to be complacent, said experts.

The current account surplus is a reflection of lower domestic consumption, production and investment and an indication of weak economic growth as a whole, they said.

The ongoing economic slowdown brought on by the coronavirus pandemic is mainly responsible for the record balance of the current account.

The surplus in the first quarter was largely caused by a reduction in the trade deficit, which occurs when a country's imports exceed its exports, to $2.03 billion driven by a steep descend in imports against dwindling exports. It stood at $3.84 billion in the first quarter of FY20.

Also, strong growth in remittances in recent months has pushed up the surplus of the current account. Between July and October, remittance hit $8.82 billion, up 43.24 per cent year-on-year.

"Import of capital machinery and intermediate goods has dropped alarmingly, shrinking the trade deficit significantly in the first quarter," said Zahid Hussain, a former lead economist of the World Bank's Dhaka office.

The lower import of the items hinted that the country's economic activity has almost stagnated, he said.

For instance, settlement of letters of credit (LCs) for capital machinery narrowed 38.93 per cent year-on-year to $594 million in the first quarter.

Industrial raw materials, intermediate goods and petroleum products also witnessed a negative growth in LC settlement.

Between July and September, the country's overall imports stood at $11.73 billion, down 11.47 per cent year-on-year. Exports rose 2.97 per cent to $9.69 billion.

"The demand of investment and consumption has been very weak in the recent period due to the economic meltdown," Hussain said.

So, the record current account does not bring any positive outcome for the economy at this moment, he said.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, echoed the same.

Imports plunged unprecedentedly in the wake of a massive decline in domestic consumption, he said.

"The surplus in the current account will squeeze when economic activities pick up," said Mansur, also a former high official of the International Monetary Fund.

The record foreign exchange reserve is also a reflection of the lower trade deficit and surplus in the current account.

The country's foreign exchange reserve stood at $41 billion on November 1 in contrast to $32.43 billion a year ago.

Some emerging economies, including India, have witnessed the same development.

India's current account balance recorded a surplus of $19.8 billion in the first quarter of FY21 compared to a deficit of $15 billion a year ago.

The neighbouring country's foreign exchange reserve posted an all-time high of $560.53 billion on October 23 in contrast to $475.56 billion on March 27.

This means both the reserve and the surplus of the current account widened to a large extent during the pandemic.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments