Brokers should be allowed to issue bonds

Brokers should be allowed to issue bonds so that they can help increase liquidity in the stock market, according to Fazle Kabir, governor of Bangladesh Bank.

Kabir made this suggestion in response to a request from Professor Shibli Rubayat Ul Islam, chairman of the Bangladesh Securities and Exchange Commission (BSEC).

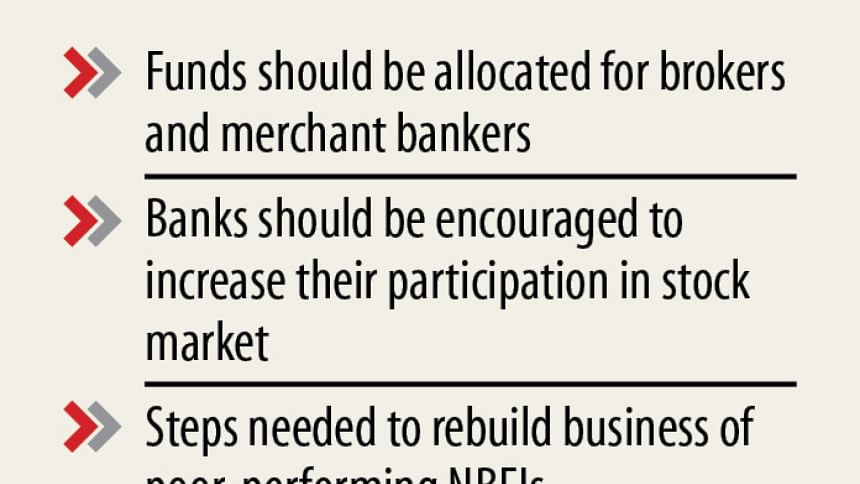

Islam had sought liquidity support for the capital market, particularly for stock brokers and merchant bankers that are burdened by excessive negative equity.

When investors buy shares by taking margin loans from brokers to add to their own funds, the stock's price tends to drop to such an extent that its value remains under the loan amount and becomes negative equity.

This discussion between Kabir and Islam took place on Sunday at the central bank's head office in Dhaka. A number of officials from both organisations attended the meeting as well.

Quoting the governor, a senior Bangladesh Bank official said a package for the country's lenders has already been announced, allowing each to set up funds worth Tk 200 crore through repurchase agreements.

The fund would not be accounted as market exposure, meaning there would be no limit on how much a bank could invest in the market from this fund, according to a Bangladesh Bank notification.

There was a scope to form funds with a total value of around Tk 12,000 crore but only 15 banks formed the fund while the rest failed to follow suit, said the central bank official.

As a result, the BSEC asked Bangladesh Bank to direct local lenders to form the fund and thereby increase the banking sector's investment in the stock market while abiding by rules and regulations.

It also urges Bangladesh Bank to resolve its regulatory issues in the foreign exchange guideline so that no issue would arise when openig online outlets for local brokerage houses in other countries.

BSEC Commissioner Shaikh Shamsuddin Ahmed and Executive Director Md Mahbubul Alam were also present at the meeting.

Bangladesh Bank seems candid in its efforts to provide any support possible for the stock market, Ahmed said, adding that market regulators were now working together for the betterment of the stock market.

Merchant banks and brokerage houses provided a huge amount of margin loans to investors while the market was bullish between 2009 and 2010.

With the loans, investors bought overvalued stocks, the prices of which eventually dropped by 60 to 80 per cent.

But merchant banks and brokerage houses were requested by the then Finance Minister Abul Mal Abdul Muhit and BSEC Chairman M Khairul Hossain not to sell the shares.

However, securities law permits brokers and merchant bankers to sell shares whenever the stock price falls to a certain level so that negative equities do not evolve.

Due to negative equity, merchant banks and stock brokers are not investing in the capital market as per the BSEC'sexpectations, Ahmed said.

They have spoken to the central bank governor on how junk non-bank financial institutions can be restructured or recovered.

The mismatch between the bank companies act and corporate governance code over the number of independent directors was also analysed in the meeting and the authorities concerned have been asked to resolve the issue, he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments