Banks’ excess liquidity doubles

Banks have faced excess funds in the recent period in the wake of a slower trend of investment against the large volume of money injection by the central bank into the financial sector.

The implementation of the stimulus packages initiated by both the central bank and the government and an upward trend of remittances are mainly responsible for the excess liquidity in the banking sector, experts said.

The Bangladesh Bank (BB) has already injected around Tk 55,000 crore in the financial sector as part of its effort to implement the stimulus packages.

The upward trend of remittances has also forced the central bank to purchase $5.08 billion from banks in order to keep the exchange rate of the taka stable against the dollar, according to data from the BB.

This means the central bank has supplied around Tk 43,000 crore to the market by way of purchasing the dollar given the existing rate between the taka and the dollar.

Between July and October, remittance hit $8.82 billion, up from 43.24 per cent year-on-year.

The central bank injected the reserve money for the implementation of the packages and purchasing the dollar.

Reserve money is also called central bank money, monetary base, base money, and high-powered money, and sometimes narrow money.

Such high-powered money inflates the overall money supply in the financial sector, given its multiplier effects.

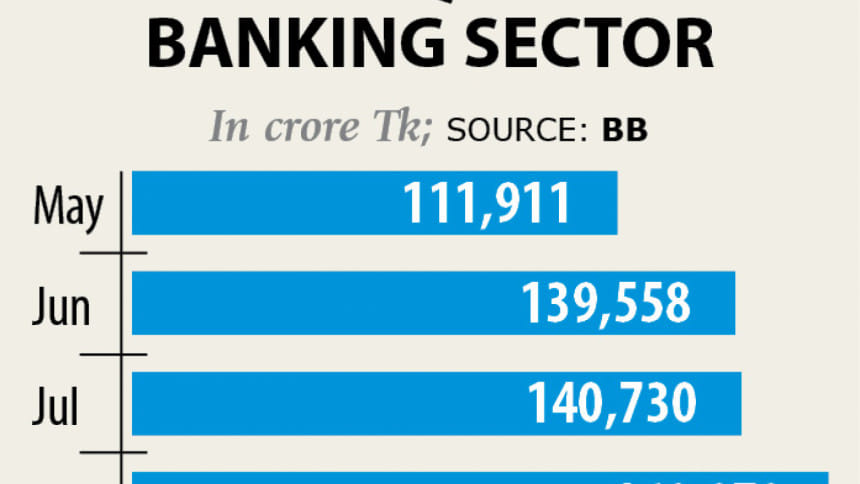

The excess liquidity in the banking sector stood at Tk 160,979 crore as of August, up from 105 per cent year-on-year.

The excess liquidity in the banking sector is a global reflection on the back of the ongoing economic meltdown caused by the coronavirus pandemic, said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

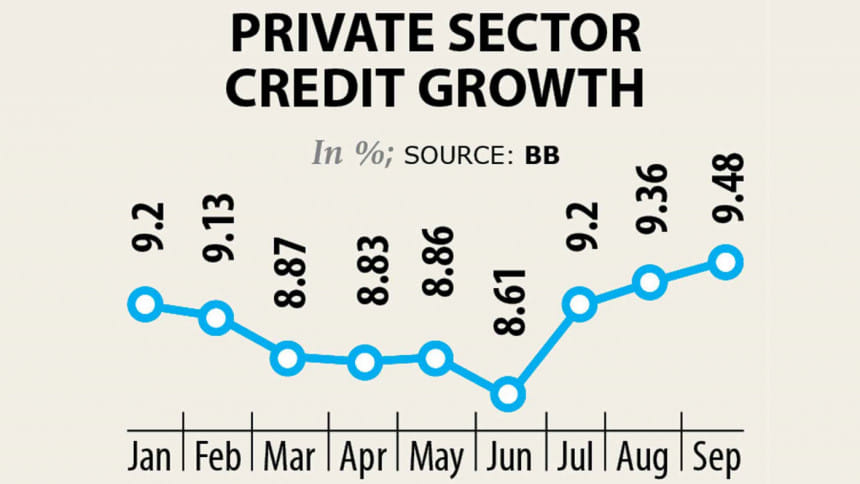

Although credit growth has slightly increased in recent months due to the implementation of the stimulus packages, the overall credit demand has been on the decline.

Businesses are persistently reluctant to expand given the economic hardship and a probable second wave of the coronavirus infection, he said.

This has compelled banks to bring down their lending rate on term loans to 7.5-8 per cent, lower than the interest rate cap of 9 per cent on all loan products set by the central bank.

The lower credit demand has reduced the interest rate on deposit products as well.

The majority of banks now mobilise deposit by offering 3.5-4 per cent interest rate for fixed deposit receipts (FDRs).

The high growth of remittances and lower credit demand have pushed up the excess liquidity in the banking sector, Mansur said.

In addition, the large corporates are bagging foreign loans at an interest rate of 3.5 per cent, much lower than the rate set by the local banks, he said.

So, these things have created a difficult situation for banks to expand their credit volume, said Mansur, also the chairman of Brac Bank.

From the economic perspective of the global market, it will take several years to normalise the ongoing unstable situation in the domestic money market, he said.

Imports have also gone down at a faster pace since the initial spread of the coronavirus, playing a role in widening the excess liquidity in the market, said Syed Mahbubur Rahman, managing director of Mutual Trust Bank.

A collapse in demand and the stagnant situation in the industrial sector has narrowed the imports of capital machinery, industrial raw materials and consumer items, he said.

Banks usually manage their lion shares of profit from lending and foreign trades, said MA Halim Chowdhury, managing director of Pubali Bank.

"So, the actual profit in the banking sector will decline because of the business slowdown," he said.

Jamuna Bank has even given out short-term loans at an interest rate of 3-4 per cent to keep the disbursement moving, said its Managing Director Mirza Elias Uddin Ahmed.

The space of the loan disbursement has narrowed to a large extent at a time when the central bank is supplying money on a regular basis to the market, he said.

"The existing excess liquidity is undoubtedly a good trend for the market. And the central bank should not mop up the fund at this moment," he said.

He, however, went on to express a fear that investment in the speculative sectors like capital market and land will widen alarmingly in the days ahead if the banking sector holds the excess fund in the long run.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments