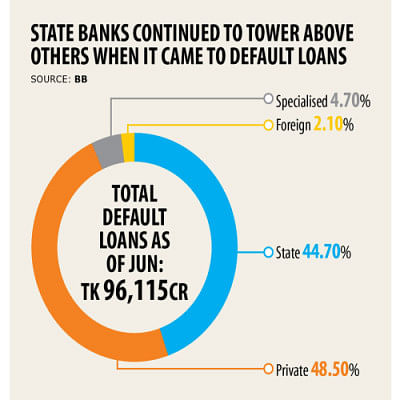

8 state banks still account for a disproportionate share of classified loans

Classified loans in the banking sector rose 3.9 per cent quarter-to-quarter to Tk 96,117 crore in June largely because of a higher volume of risky assets at private and state-run specialised lenders.

June's figure accounted for 9.2 per cent of the total outstanding loans, data from the central bank showed.

In March, Tk 92,510 crore was classified, which was 9 per cent of the outstanding loans at the time.

A classified loan is a loan that is in danger of default. Classified loans have an unpaid interest and principal outstanding but don't necessarily need to be past due. As such, it is unclear whether banks will be able to recoup them.

As a result, banks need to set aside funds from their income to minimise net classified loans under a loan-loss provision, a system that guarantees a bank's solvency and capitalisation if and when the defaults occur.

The system accounts for future losses on loan defaults as banks assume a certain percentage of loans will turn sour or become slow-paying.

Poor lending practices, a lack of corporate governance and the government's interference in banks were the main reasons behind the rise in risky loans in recent times.

The coronavirus pandemic, which arrived on the shores of the country in March, made the situation worse as economic and business activities came to a standstill in April and May and coronavirus-induced disruptions to domestic and export demand deteriorated lenders' credit profiles.

Private sector banks saw the sharpest increase in the classified loans in the second quarter of the year. They had a combined classified loan of Tk 46,592 crore in June, up 7.2 per cent from a quarter earlier.

The risky loans at state-owned specialised lenders rose 11.5 per cent to Tk 4,521 crore, which accounted for 15.9 per cent of the outstanding loans.

In March, they were sitting on Tk 4,054 crore in classified loans, which were 15.1 per cent of the outstanding loans, BB data showed.

Classified loans at state-owned banks nudged up marginally to Tk 42,939 crore at the end of June, against Tk 42,873 crore in March.

Foreign banks, however, saw a 0.7 per cent decrease in classified loans to Tk 2,063 crore in June, which was Tk 2,077 crore a quarter earlier.

As a result, the share of the risky loans in their outstanding loans came down to 5.5 per cent from 5.6 per cent earlier.

Although the classified loans are on the rise, banks in Bangladesh don't seem to be much bothered as only a handful of them are preparing for the likelihood of an increase in defaults.

This may be because banks are feeling comfortable as the central bank has given a regulatory forbearance, barring them from classifying loans until September in case of a failure to pay instalments by businesses given the ongoing financial recession. The deadline may be extended to December.

The country's banking sector has faced a provisioning shortfall in recent years due to a lack of corporate governance.

For instance, a total of Tk 3,619 crore was reported as provisioning shortfall against the required amount of Tk 60,493 crore in the first quarter of 2020, data from the central bank showed.

But the scenario is completely different in the developed world.

For example, American banks have set aside $115 billion for expected loan losses in the first quarter of 2020, according to an article of S&P Global Ratings.

Banks in the US sharply increased their allowances in the first half, positioning them to absorb at least a meaningful portion of the loan losses that may be coming because of the economic downturn triggered by the pandemic, it said.

"However, they are far from out of the woods. If loan losses triggered by the pandemic rise to our base-case expectation of 3 per cent, banks may need to double or triple the large provisions they took in the first half of the year."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments