NBR moves to boost payroll taxes

Companies will have to submit a list of employees and their taxpayer identification numbers to the National Board of Revenue while showing their salary expenses -- a move by the revenue authority to boost payroll taxes.

If employers fail to do so, the salary payment that they have made will be treated as income and will be taxable.

The step will prevent companies from claiming higher expenses by showing “ghost employees” on the payroll, as TINs have been made mandatory for employees who get a pay of Tk 16,000 or above a month.

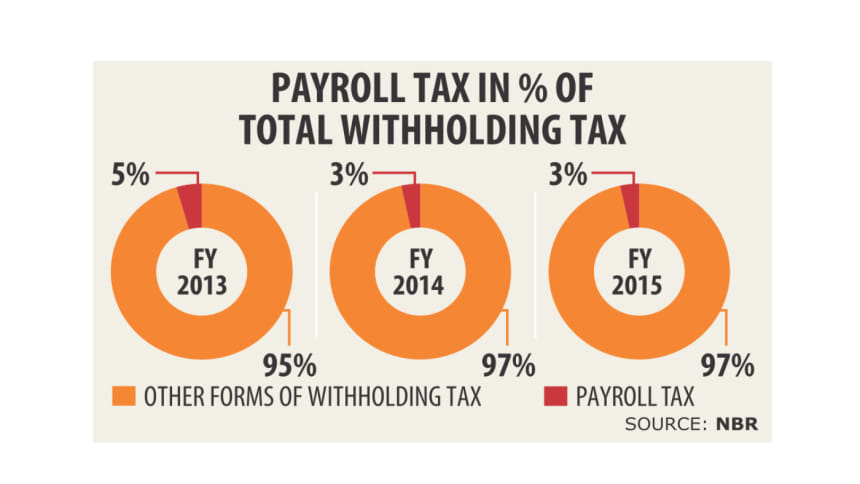

The move also aims to accelerate collection of payroll taxes, which is only 2 percent of total income tax collected in a year, said taxmen and analysts.

“We will now know how many people work at the management and supervisory level of a company,” said a senior official of the NBR, asking not to be named.

About 95 percent of the employed people work in the private sector. Of the employed, 2.4 crore are paid employees and half of them receive salaries on a monthly basis, according to Labour Force Survey 2013 by Bangladesh Bureau of Statistics.

The number of managers, professionals, technicians and associate professionals is 34.80 lakh or 14.6 percent of the total paid employees. People in these three groups have an average monthly income between Tk 17,746 and Tk 21,323, according to the survey. Taxmen said they do not get the proper amount of taxes from salaries and as a result, its contribution to total income tax collection remains low.

Taxmen got Tk 979 crore as withholding tax from salaried persons in fiscal 2014-15, a 29 percent hike from the amount in the previous year, according to NBR.

In his budget speech, Finance Minister AMA Muhith, citing the low collection from payroll taxes, said there is persistent noncompliance in withholding tax.

The payroll tax is more than 30 percent in developed countries, he added.

The NBR official said, even in India and Pakistan, the payroll tax accounts for more than 15 percent of the total withholding tax.

To curb such tax evasions, the NBR earlier tagged a condition that salaries should be paid through banking channels.

Taxmen said mandating the payment of salaries in excess of Tk 16,000 based on TIN will be instrumental in improving compliance.

But employees will not need to take any extra burden, such as return submissions, if their incomes stay below the tax-free threshold of Tk 2.50 lakh a year.

Ahsan H Mansur, executive director of Policy Research Institute of Bangladesh, praised the step taken by NBR.

“The potential of payroll tax is very high here. But the NBR has to strengthen its monitoring and enforcement,” he said.

Mansur, a former economist of the International Monetary Fund, said a large chunk of payroll tax is being evaded in Bangladesh in absence of proper monitoring and follow-ups.

“Payroll tax management should be automated so that employers can report directly to the tax authority using the internet.”

In his budget speech, Muhith said NBR is working to form a new Tax Deduction At-source Zone. “For robust withholding tax management, a new Withholding Tax Unit will be established.”

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments