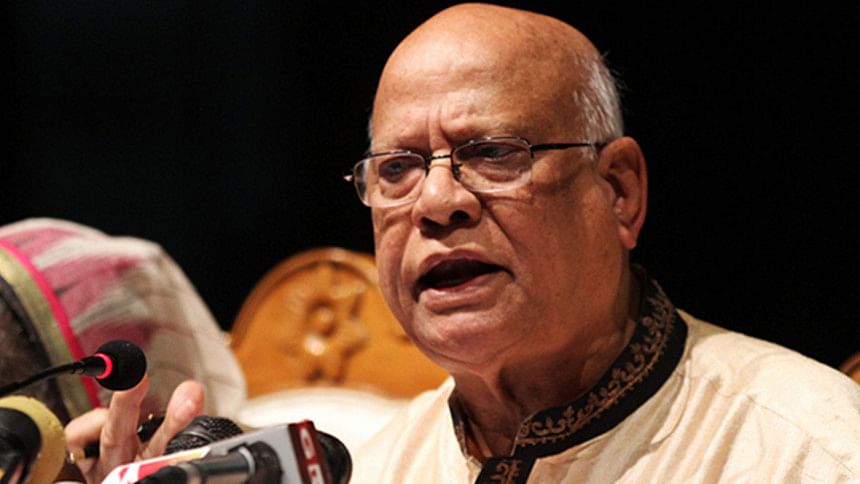

Muhith firm on 15pc uniform VAT

Finance Minister AMA Muhith will not budge on his plans to introduce a 15 percent uniform VAT rate from July, but he might soften his stance on turnover tax, according to officials.

Muhith yesterday sat with two other ministers and a number of top business leaders to discuss the new VAT and Supplementary Duty Act 2012 at the secretariat.

After the meeting, Muhith said, “I told them two things: the new VAT law will come into force from July 1 and the rate will be uniform [15 percent].”

“But more discussion will take place. I admit there is apprehension about the new law.”

Commerce Minister Tofail Ahmed termed the meeting fruitful. “We make decisions by taking many things into consideration,” he added.

“On one hand, we have to implement the new VAT law, and on the other hand, we will have to protect the interests of the general people.

“The honourable finance minister will take realistic steps,” said Tofail.

Industries Minister Amir Hossain Amu, former presidents of the Bangladesh Chambers of Commerce and Industry AK Azad and Salman F Rahman and FBCCI First Vice-president Md Shafiul Islam Mohiuddin were present at the meeting.

Business leaders reiterated that the existing multiple VAT rates should continue, said an official present at the meeting.

They urged the government to increase the limit of turnover tax from Tk 80 lakh to Tk 5 crore and re-fix the turnover tax at 0.5 percent instead of 3 percent.

Under the new law, businesses will have to maintain proper records of their transactions, which the business leaders have opposed.

The finance minister hinted that he might relax the provisions on turnover tax and the rates in the upcoming budget.

On Sunday, the Centre for Policy Dialogue said the proposed uniform VAT rate of 15 percent for Bangladesh is on the high side when compared to neighbouring low and middle-income countries.

The global median rate for VAT is 15 percent, but in South and East Asia and among the low and middle-income countries in general, the median appears to be 12 percent, it said.

If a uniform VAT rate is to be implemented from July 1, it is recommended that the rate be gradually reduced to 12 percent over a medium term, the CPD said.

The think-tank warned that the cost of production in almost all sectors might go up in the coming months as a result of the new VAT law.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments