Most life insurers overshoot spending limits

Some 28 of the 31 life insurers breached their respective limits on expenses last year, according to the Insurance Development and Regulatory Authority or IDRA.

In 2013, only Metlife spent within the limits, but in 2014, two local insurers -- Meghna Life and Rupali Life -- have joined the foreign insurer to put brakes on their expenses.

IDRA has now decided to hire an external auditor to examine the expenses of life insurance companies before taking stringent actions against the violators.

“We have failed to bring down the management expenses by moral persuasion. We'll now appoint an auditor to assess their costs,” Shefaque Ahmed, chairman of IDRA, told The Daily Star.

Management expenses are all charges incurred, whether directly or indirectly, according to insurance laws.

It includes commission payments of all kinds and any amount of expenses capitalised, among others. This includes office management and branch expansion expenses.

On average, it is capped at 97.5 percent of first-year premiums, and if the company has been in operation for 10 years, it is 90 percent. No company is allowed to exceed these expenses in any calendar year.

It is calculated as a percentage of the premium (first-year and regular premium) and the size of the business.

Insurers in Bangladesh hardly follow the rule on the expenses as the companies know they will be fined nominally for violation.

An insurer will be fined a maximum of Tk 5 lakh for violation of the rules for management spending, according to the Insurance Act 2010.

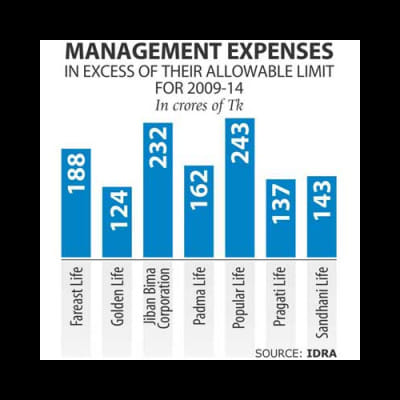

IDRA data shows 17 life insurers, which came into the market in 2000 or before, spent nearly Tk 1,800 crore in excess as management costs in six years till 2014.

If IDRA imposes fine at the highest ceiling (Tk 5 lakh each), the total amount would stand at a meagre Tk 85 lakh.

Over expenditure was a practice in India also, but the regulator there imposed vigorous punishment few years ago.

Now, if the limit was breached by insurers in India, the excess amount would come out of the shareholders' account.

IDRA data shows new life insurers that came into the market in 2013 spent the most: Guardian Life Insurance spent additional 354 percent, Chartered Life Insurance 254 percent, Swadesh Life Insurance 220 percent and Alpha Life Insurance 198 percent from their allowable limits.

Life insurance companies, especially in the first five years of their business, have a higher cost-head, due to expansion of business, recruitment of staff, setting up new branches and marketing expenses.

But insurance companies of 10 to 20 years old are spending higher than the limit.

Even state-run Jiban Bima Corporation spent Tk 50 crore more than its allowable management expenses for 2014. First generation insurance companies that have been doing business for over two decades have spent far more than the limit.

For example, Pragati Life Insurance spent 31.5 percent higher, Padma Islami Life 43.39 percent, Popular Life 12.4 percent, Sandhani Life nearly 29 percent and Fareast 22 percent more than their limits as management expenses. BM Yousuf Ali, managing director of Popular Life Insurance, said management expenses have been declining for them and some other companies in recent years.

Popular Life's excess management cost has come down to 12 percent last year from 18 percent in the previous year, he said.

The cost will be brought down to the allowable limit in five years, Ali said, adding that credit goes to the regulator that has been persuading insurers to effectively use the policyholders' money.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments