Mobile operators' revenue per user goes up

Mobile operators' average revenue per customer increased in 2016 on the back of rising popularity of data service and infotainment.

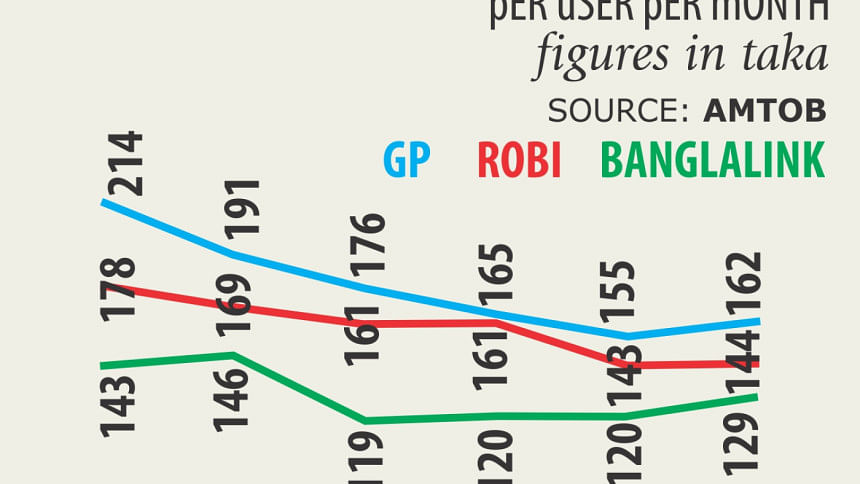

In 2016, market leader Grameenphone's average revenue per customer increased 4.52 percent year-on-year to Tk 162, Robi's 0.7 percent to Tk 144 and Banglalink's 7.5 percent to Tk 129, according to a report of the Association of Mobile Telecom Operators of Bangladesh.

But operators said the users did not actually spend more on mobile phone services last year: biometric re-registration last year condensed the subscriber base, so the average revenue per user went up. In essence, their earnings have remained flat.

When viewed from a historic perspective, the mobile operators' average revenue per customer is on a declining trend.

For instance, in 2011, Grameenphone's average revenue from per active SIM was Tk 214, Robi's Tk 178 and Banglalink's Tk 143.

If the trend continues, there might not be any further investment into the sector.

Amtob shared its grievances with the finance minister, the National Board of Revenue and the other stakeholders before the budget for fiscal 2017-18 was placed in the parliament on June 1.

“This situation might be unsustainable in the long-term,” said TIM Nurul Kabir, secretary general of the Amtob.

The mobile operators in Bangladesh are now offering the second lowest tariffs in the world after Vietnam, and yet they are subjected to one of the highest tax rates.

Telecom is a highly regulated industry and the operators cannot just hike the tariff as they wish, Kabir said. “It has to be approved by the government.”

“Bangladesh's per capita income has increased. Everything is getting costlier save for the telecom tariff.”

The operators' expenditures have increased severely as well, he said.

Subsequently, he urged the government to look into the matter as its revenue is tied to the operators' earning ability and sustainability.

“In our neighbouring countries, the government and regulator help to increase the tariff, which ultimately helps in digitisation,” Kabir added.

Top officials of the leading mobile operators also urged the NBR to help them to increase tariff as it would untimely help to better the service quality.

Operators are earnestly trying to increase their revenue by tagging in new services like entertainment, e-education, gaming, e-commerce, utility bill payment.

Currently, there is a floor and upper ceiling for terminating calls: Tk 0.25 and Tk 2 respectively for every minute of local call.

The data price and SMS rate also declined sharply due to intense competition in the market.

One the other hand, customers want cheaper tariff for mobile services.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments