Loan defaults spiral back up

Loan defaults at banks rose 15.65 percent to Tk 59,411 crore in the first quarter of 2016 from the previous period due to a combination of weak governance, aggressive lending and a seasonal effect.

This reversed the trend since the last quarter of 2015 when defaults dropped 6.22 percent to Tk 51,369 crore from the previous quarter.

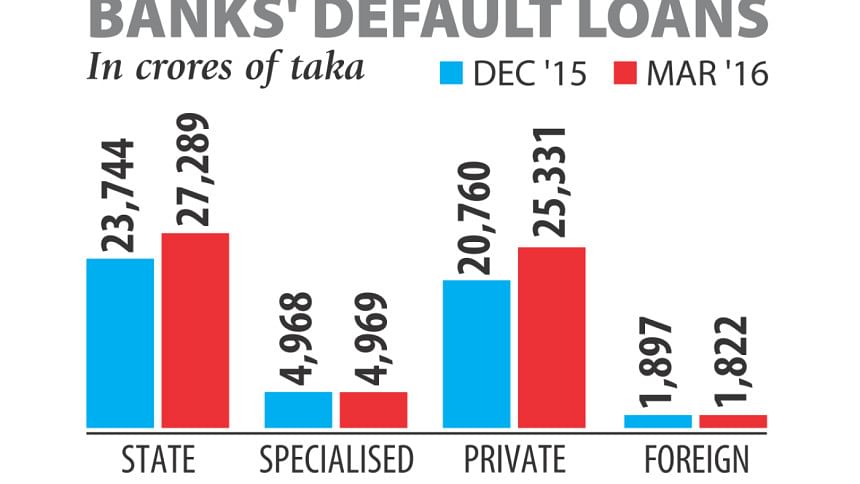

Soured loans increased significantly at state and local private banks. On the other hand, defaults at foreign banks and two state-run specialised banks remained at the level of the last quarter of 2015.

Between January and March, defaults at state banks jumped 14.93 percent while private banks saw a 22 percent increase, according to data from the central bank.

Khondker Ibrahim Khaled, a former deputy governor of Bangladesh Bank, said bad loans at state banks are on the rise because of corruption, while defaults are piling up at private banks due to aggressive lending.

Loans sanctioned without due diligence in the last two to three years are not being recovered, he said.

The former banker blamed rising bad loans on dishonesty and a lack of professionalism at state banks.

Honest people are not appointed to the boards and the management of the banks, Khaled alleged.

But Anis A Khan, chairman of the Association of Bankers Bangladesh, played it down and said there is no need to worry too much about the private banks' defaults.

Close to December, banks usually tighten their leash on bad loans, said Khan, also the managing director of Mutual Trust Bank.

In February-March, banks become a bit slack in their work, which often leads to an increase in bad loans. “This is a seasonal effect.”

Khan said some loans were rescheduled the previous year, but the borrowers have not made the repayment, pushing up the bad loans again.

On March 31 this year, bad loans accounted for 9.92 percent of the total loans in the banking system, while it was 8.79 percent on December 31 last year.

The defaults of state banks rose by Tk 3,545 crore to Tk 27,289 crore, which is 24.27 percent of their outstanding loans.

Default loans at private banks increased by Tk 4,571 crore to Tk 25,331 crore in January-March. It amounted to 5.75 percent of their total outstanding loans.

Defaults at foreign banks were Tk 1,822 crore as of March, accounting for 7.5 percent of the total loans. Two state-owned specialised banks' default loans did not go up in the first quarter. Their bad loans are already very high, at 23.24 percent.

In other South Asian countries, the default loans are now below 10 percent.

Two economists have called for the government to immediately privatise state banks except Sonali to stop them from bleeding the economy.

“I think enough is enough. We no longer need state banks,” said Mohammed Farashuddin, a former central bank governor, at a meeting on May 13.

“We only need to keep Sonali Bank, which is our treasury bank. Other state banks should be left in the hands of people,” he added.

Sadiq Ahmed, a former director of the central bank, wholeheartedly backed Farashuddin.

Ahmed called for turning the state banks into narrow banks, if they are not privatised. Narrow banks can only take deposits; they cannot lend.

“If you can take away the lending decision, there will not be any scope for misuse and abuse,” the former World Bank economist said in the same programme.

In India, a majority of the banks are state-owned and are running well and making profit, Khaled told The Daily Star yesterday.

Privatising state banks is not a solution for Bangladesh, he said. “Measures should be taken so that state banks can function without government intervention,” he said.

“The finance ministry should not interfere in the state banks -- not in any appointment,” he said, adding that an independent committee should select the state banks' boards and top management.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments