Home buying, much cheaper now

Even as recently as 4-5 years ago, it was inconceivable to many low- and middle-income households in Dhaka city to aspire to own property of their own, and get out of the expensive rental trap.

Now, that dream is within the grasp of many.

An apartment in Mirpur, which was selling at Tk 5,000-Tk 6,000 per square feet about five years ago, is now available at Tk 3,500-Tk 4,500, said Sardar Md Amin, vice-president of the Real Estate and Housing Association of Bangladesh (REHAB), the industry group.

Similarly, the prices of a flat in Dhanmondi have dropped as low as Tk 10,000 per square feet from the peak of Tk 22,000 four years ago. The prices have also dropped in other areas.

The apartment prices fell 20 to 30 percent over the last couple of years from its peak in 2011-12, said Toufiq M Seraj, managing director of Sheltech (Pvt) Ltd, one of the leading developers.

The correction in property market came after realtors registered steady growth in demand since the turn of the millennium.

With newly-found wealth and rising purchasing power, people started to buy plots and apartments, channelling their incomes into the sector.

Lured by the increasing demand for property, a large number of firms signed up for the trade between 2001 and 2012. As a result, competition to secure land from owners rose, which, in effect, gave more clout to property owners to bargain for higher number of flats from the multi-storied buildings to be erected on their lands.

“An uneven competition started. Land owners claimed unrealistic property share, so the property price rose to its highest level,” Seraj said.

At the same time, due to unrealistic competition apartment supply went beyond the demand, he added.

Amin has an example.

In 2009, developers could get a plot in Shewrapara at 70:30 ratio, meaning that the land owner will get 30 percent of the apartments built on the land.

In 2012, the ratio spiralled to 50:50. In addition, the developers have to pay Tk 1 crore in advance to the land owner, he said.

Industry operators said many of the new entrants took up expensive projects, a great number of which were even sold.

But the bubble soon burst, prodded by intermittent political instability, a squeeze on bank loans, a bearish stock market and the government's apathy towards providing gas connections to new buildings.

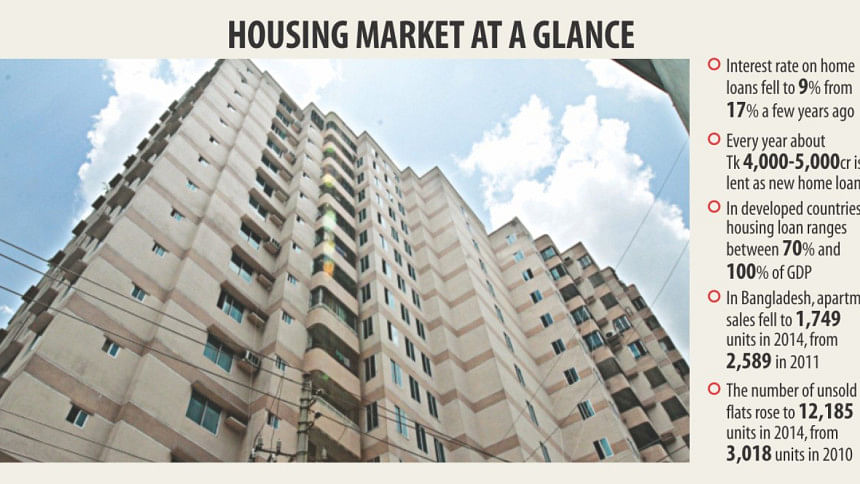

Apartment sales hit rock bottom in 2014, when 1,749 units were sold, in contrast to 2,589 units in 2011, according to REHAB data.

The number of unsold apartments rose fourfold, from 3,018 units in 2010 to 12,185 units in 2014, according to REHAB.

But the scenario began to change from the second half of 2015 as price correction along with falling interest rate on home loans and the return of political stability started to lure prospective buyers to the housing market.

Seraj said the real estate sector is slowly recovering from the downturn.

The interest rate on home loans has fallen to as low as 9 percent from 17 percent a couple of years ago, according to realtors and bankers.

The lack of investment opportunities in the face of falling returns on savings and fixed deposits and a bearish trend in the stockmarket have also encouraged many to turn to the housing sector, said Mohammad Farhaduzzaman, marketing in-charge of Eastern Housing Ltd, one of the oldest realtors.

REHAB is yet to finalise the sales figures for 2015.

Ahsan H Mansur, executive director of Policy Research Institute, said the main problem in the housing market is the mismatch between the cost of housing and the returns on them.

The mismatch is now narrowing because of the reduction in real housing prices.

“The prices of apartments have fallen to half in real terms,” he said.

This coupled with the increased income and falling interest rates has made flats more affordable to people.

“That is good. Homes are more affordable today than before,” said Mansur, also a former economist of the International Monetary Fund.

But despite the fall, the prices are still high. The huge price correction indicates that the market is working.

“There will be some real adjustments. And it will take 1-2 years for the housing sector to turn around. Our builders made so much money between 2008 and 2012 -- they wouldn't have earned that in their lifetimes otherwise.” Mansur said the sector would get a boost if the banks and financial institutions slashed the interest rates further. “That will be the biggest boost to the sector.”

He recommended that the government should develop a mortgage-based bond market. “This is the main reason that the majority of the people in industrial countries have their own homes.”

Mortgage interest payments are tax deductible in many of those countries, according to Mansur. “This will promote housing.”

But foremost, Rajdhani Unnayan Kartripakkha (Rajuk) should get out of the land and housing schemes.

“It should be given to the market -- Rajuk should play the role of a regulator,” he added.

Mominul Islam, managing director of Industrial Promotion and Development Company of Bangladesh Ltd, a non-bank financial institution, said there is a huge opportunity for growth in housing finance in Bangladesh.

Every year about Tk 4,000-5,000 crore is lent as new home loans, with outstanding housing finances standing at 3.5 percent of gross domestic product.

“This is very low. In developed countries, the housing loan ranges between 70 percent and 100 percent of GDP, while in Malaysia it is 40-50 percent of GDP. In India, it is 11 percent of its GDP.”

The current housing sector is catering to only small group of people, he said. “We need to make sure that we develop a model so that it can go to a larger group of people across the country.”

Some developers are moving out of Dhaka and Chittagong and going to cities like Comilla, Mymensingh, Bogra, Khulna and Jessore.

“But this needs to be further escalated. If the developers build apartments as a basic necessity for the mass, the market demand for their products will always remain strong. So, they will not see this kind of volatility in the market.”

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments