Higher growth hinges on reforms: CPD

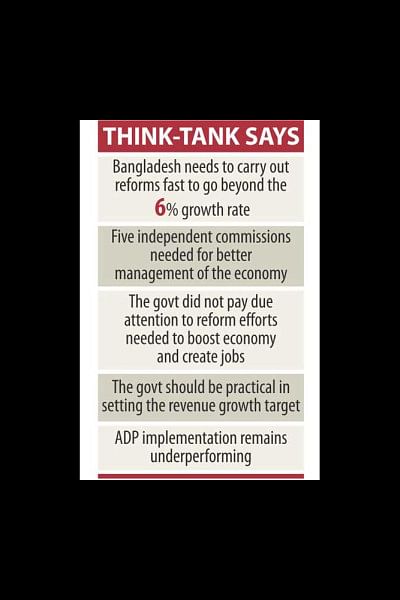

The Centre for Policy Dialogue yesterday urged the government to boost reforms and set up five independent commissions for better management of the economy.

“The prevailing macroeconomic stability along with lower price levels will support such a plan,” the CPD said in its review of Bangladesh economy for the outgoing fiscal year.

The recommended commissions are for the areas of agriculture price, local government financing, public expenditure review, financial sector reform and a statistical commission to validate the macroeconomic correlates.

Towfiqul Islam Khan, a research fellow of the CPD, made a presentation on the report, while Debapriya Bhattacharya, distinguished fellow, Mustafizur Rahman, executive director, and Khondaker Golam Moazzem, additional research director, also spoke at a discussion on the report at Cirdap auditorium in the capital.

The CPD's report on the economy was based on the data available for the first nine months of fiscal 2014-15.

“Bangladesh needs to carry out institutional and policy reforms fast, if it wants to go beyond the 6 percent plus growth rate,” Bhattacharya said.

Rahman said the government did not pay due attention to different reform initiatives needed to boost the economy and create much needed employment.

The report found that the current fiscal year is closing with a number of macroeconomic advantages, such as lower inflation, declining interest rate, stable exchange rate, manageable fiscal deficit, positive balance of payments and augmented foreign exchange reserves.

Also, the low level of global commodity prices, including that of oil, has provided some respite in terms of resources needed to meet subsidy demands.

Some of the fault lines of the elapsing fiscal year included unachieved revenue targets, low flow of foreign assistance, sluggish exports to the US market, and failure to ensure incentive prices to rice farmers, the think tank said.

Acceleration of private investment remained an illusive target and bridging the infrastructure gap did not experience much discernible success, the report said. Private sector credit growth was only 13.6 percent during July-March this year.

The CPD said all these opportunities and challenges are going to define the benchmarks for 2015-16.

The review report also questioned the GDP growth estimate of 6.51 percent for the outgoing year, as a quarter of the year was badly affected by political turmoil.

Manufacturing is estimated to have achieved a significantly high growth of 10.3 percent despite severe disruption in the supply chain during the political turmoil, the report said.

The services sector's estimated growth rate of 5.8 percent in fiscal 2014-15 is a surprise to the CPD as the sector was affected by political unrest.

“A more disaggregated analysis is necessary to determine how the manufacturing sector could achieve such growth, which represents a moderate share of between 19 and 20 percent in GDP,” the report pointed out.

The think tank also urged the government to be practical in setting the revenue growth target as it found a shortfall of Tk 25,000 crore for the outgoing year.

The CPD called upon the government to be cautious while borrowing to finance the budget deficit. “There may potentially be pressure for domestic interest payments in fiscal 2015-16 in view of the buoyant sale of national savings instruments during the current year,” it said.

The implementation of the annual development programme (ADP) remained underperforming business as usual. According to data for the first 10 months of the fiscal year, actual spending under the ADP was 51.8 percent of the originally planned allocation of Tk 80,315 crore.

The CPD also analysed the updates on 26 projects under this year's ADP that were supposed to help boost growth and employment. Fourteen of the 26 projects were supposed to be completed in the current year. A total allocation of Tk 21,392 crore was needed for timely completion of these projects, but only Tk 5,362 crore was earmarked for these projects in the revised ADP.

Subsidy requirements are expected to remain as a downside in the upcoming fiscal year amid low oil prices in the global market, the CPD said. Bangladesh Petroleum Corporation (BPC) is expected to make a profit of around Tk 2,000 crore and no longer requires subsidies in the outgoing year.

The think tank predicts that the surplus may be partially passed through to source the Bangladesh Power Development Board's planned demand of Tk 7,500 crore in fiscal 2014-15. The CPD suggested that, rather than a price rationalisation, adjustments of administered prices should be considered as part of a single package.

For fiscal 2015-16, the government should consider a marginal adjustment of electricity and gas prices and keep the petroleum prices as they are, the CPD said, adding that it is rather important that the BPC uses its profit to repay its long-standing loans to state-owned banks.

The think tank also raised a question over the impressive growth of payments against capital machinery import -- 23 percent during the first nine months of the outgoing year. The CPD reiterates its demand to investigate this growth in capital machinery imports.

Bhattacharya hailed the growing bilateral relationship between Bangladesh and India, especially the recent development in the motor vehicle deal involving Bhutan and Nepal. He also said the proposed coastal shipping connectivity will reduce export-import business costs between Bangladesh and India.

He, however, raised questions over Bangladesh's expenditure on infrastructure that will be used by India as there is no clear policy on the issue.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments