Four in five households have access to financial services

Four in five households in Bangladesh have access to financial services, thanks to improvements in the networks of banks and microfinance institutions as well as a booming mobile banking segment, according to a new study.

Access to financial services, including insurance, stood at over 79 percent in 2014, compared to 77 percent in 2010, the study by Institute of Microfinance (InM), a microcredit think-tank, showed.

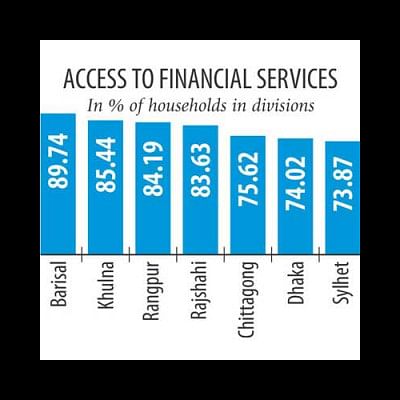

Barisal division, at 89.74 percent, has the highest percentage of households with access to finance, followed by Khulna with 85.44 percent, Rangpur 84.19 percent, Rajshahi 83.63 percent, Chittagong 75.62 percent, Dhaka 74.02 percent and Sylhet 73.87 percent.

The InM conducted the study between 2010 and 2014 to measure financial inclusion in Bangladesh, covering all seven divisions except Rangamati.

The paper was presented at a seminar at the national convention on 'Inclusive Finance in Bangladesh' at Bangabandhu International Conference Centre in Dhaka yesterday.

Prof MA Baqui Khalily, executive director of InM, presented the study at the seminar. He co-authored the study along with InM researchers Mehadi Hasan, Nahid Akhter, Farah Muneer and Pablo Miah.

Bangladesh is one of the leading countries in South Asia where households have higher access to financial services.

In 2010, the formal financial market consisted mainly of bank services such as savings, credit and insurance, according to the study. However, with the emergence of mobile banking, it now includes households that have mobile banking accounts.

The study revealed that more households can now access the formal financial market, as it went up 5 percentage points between 2010 and 2014.

More than 40 percent of households in rural regions can access formal financial services, which was 32.8 percent four years ago. In urban areas, 49.76 percent households have access to formal financial services, against 53.53 percent in 2010.

Access to formal financial services by poor households that are constrained by service charges, collateral and a lack of financial literacy, stood at 24.19 percent in 2014, up from 19.53 percent in 2010.

In 2014, 47 percent of households were able to access microfinance, which was 43.23 percent four years ago.

The study shows that fewer households are accessing the informal financial market for credit, as it fell below 20 percent in 2014.

There are still many households that do not have access to financial services. Day labour-led households are one of them, as almost a quarter of them do not have access to any financial market. Less than 24 percent of day labour-led households have access to formal finance and almost 57 percent are capable of accessing the microfinance market.

However, 46 percent of households do not have access to credit in any market. In the banking sector, 59 percent of households are credit constrained. It is 35 percent in the case of microcredit. The study said it is essential to innovate and improvise financial products to broaden the outreach of financial services offered by institutions.

For financial inclusion, it recommendations expanding financial services in unbanked areas; reducing transaction cost of borrowing; improving financial literacy; mobilising financial resources; initiating targeted programmes for women-headed households; strengthening insurance sector; and protecting customers against abuses.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments