FDI rises 9.27pc

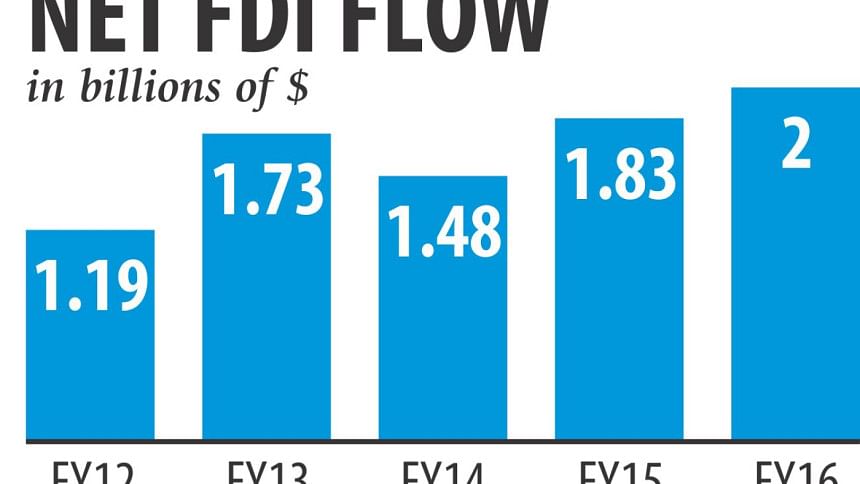

Foreign investment increased 9.27 percent year-on-year in fiscal 2015-16 due to an improvement in reinvestment in existing companies.

Last fiscal year, net foreign direct investment stood at $2 billion in contrast to $1.83 billion a year earlier, according to data from the central bank.

Foreign investment is split into three categories: equity, reinvestment of earnings and intra-company loan.

Last fiscal year, equity capital or new investment declined 4.35 percent from a year earlier to $505 million. However, reinvestment of earnings edged up 1 percent to $1.15 billion.

Intra-company loans more than doubled year-on-year to $344 million during the period.

More than 50 percent of the recent FDI are actually reinvestment by existing companies.

This is a positive sign since it indicates that the foreign companies are earning sufficient revenue to run their business and their confidence is growing, said a World Bank report released early this month.

On the other hand, a deceleration in the contribution of equity capital to the total share of FDI inflows is indicative of the continuing lack of enthusiasm on the part of new investors to invest in Bangladesh, the report, Bangladesh Development Update, added.

The WB comment comes at a time when fresh foreign investment dropped about 10 percent.

Private investors are discouraged from investing in Bangladesh because of infrastructure deficits, scarcity and high prices of land, corruption, political uncertainty and, of late, concerns about security, the WB report said.

Severe scarcity of gas and electricity is making the process of getting utility connections for new businesses difficult.

Currently, about 2,000 new businesses are waiting to get electricity connections.

The demonstration effect of such delays on new investment is bound to be negative, said the Washington-based multilateral lender.

The cost of investment has increased as a result of scarce and high priced land for industrial purposes. “This is preventing many large companies from investing.”

The WB said the most recent evidence from Doing Business indicators provides very little comfort.

Bangladesh remains well behind countries such as India, Sri Lanka, Pakistan, Nepal, Thailand and South Korea on getting electricity, dealing with construction permits, registering property and enforcing contracts.

The political turmoil of fiscal 2013-14 and fiscal 2014-15 in the country adversely affected investor confidence and recent terrorist attacks have delayed the restoration of investor confidence back to normal levels.

Bangladesh runs the risk of losing both domestic and foreign investor interest if the fear of more such attacks in the future is not assuaged, the WB said.

In fiscal 2015-16, Bangladesh's gross FDI receipt was $2.5 billion but after disinvestment of about $499 million the net FDI stood at $2 billion, according to data from Bangladesh Bank.

However, in comparison to fiscal 2014-15, disinvestment was lesser last fiscal year. In fiscal 2014-15 the amount of disinvestment was $691 million.

Last fiscal year, $450 million flew in from the US as FDI, $307 million from the UK, $138 million from South Korea, $132 million from Singapore, $126 million from Hong Kong, $113 million from Norway, $112 million from Malaysia and $88 million from India. Textile, telecom, banking, gas and petroleum and power sectors saw 73 percent of the FDI inflows.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments