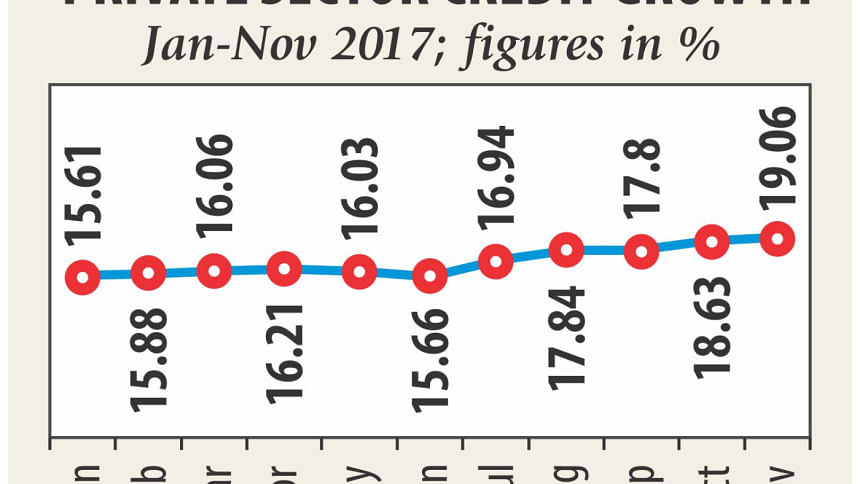

Private sector credit growth hits 19pc

Private sector credit growth continued its ascent in November, crossing the 19 percent-mark last month on the back of banks' aggressive lending to log in profits amid the low lending rate.

Last month, private sector credit growth stood at 19.06 percent, which is far beyond the target of 16.2 percent set by the Bangladesh Bank for the first half of the fiscal year.

The last time the credit growth was this high back in March 2012, when it stood at 19.5 percent. In January, the credit growth was 15.61 percent. From July it accelerated.

The unusual credit growth has got the central bank concerned as it will put pressure on inflation, which is already on the rise, said a senior BB official.

"Necessary measures will be taken to curb the credit growth in the upcoming monetary policy," he added.

As the lending rate was subdued throughout the year, banks are lending expansively as a last-ditch effort to book flattering profit figures for 2017, said Md Arfan Ali, president and managing director of Bank Asia.

"But the demand for credit is also on the rise," he added.

Some banks are lending aggressively to make more profit and hence causing the higher private sector credit growth, said MA Halim Chowdhury, managing director of Pubali Bank.

On December 17, the BB froze Tk 51 crore from ONE Bank's current account with the banking regulator and Tk 25 crore from Premier Bank's for their aggressive lending practices that took them way past the permissible limit for loan-deposit ratio.

BB warned two more -- Islami Bank Bangladesh and Union Bank, both Shariah-based banks -- of the same consequence if they did not check their reckless ways.

To support their aggressive lending, many banks are now hunting for deposits by offering 1-1.5 percent higher interest rate as bait.

As of October, the banking sector's average interest rate on lending was 9.39 percent and on deposit 4.89 percent, according to data from the BB.

For instance, Sonali on December 28, the last working day of the year for banks, got a request for withdrawal of Tk 185 crore from the Bangladesh Telecommunications Company Ltd.

The telecom company asked Sonali to transfer the amount to seven private banks: Exim, IFIC, Jamuna, Mercantile, One, Standard and Social Islami.

But Sonali declined to honour the request as withdrawal of such a large amount on the last transaction day of 2017 would have a negative impact on the balance sheet.

"As a result, both the deposit and lending rates have started to move upwards," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments