Tk 282 crore whitened through stocks

Just Tk 282 crore was whitened by means of investments in the stock market in fiscal 2020-21 despite a government provision stipulating that no authority would be able to question the source.

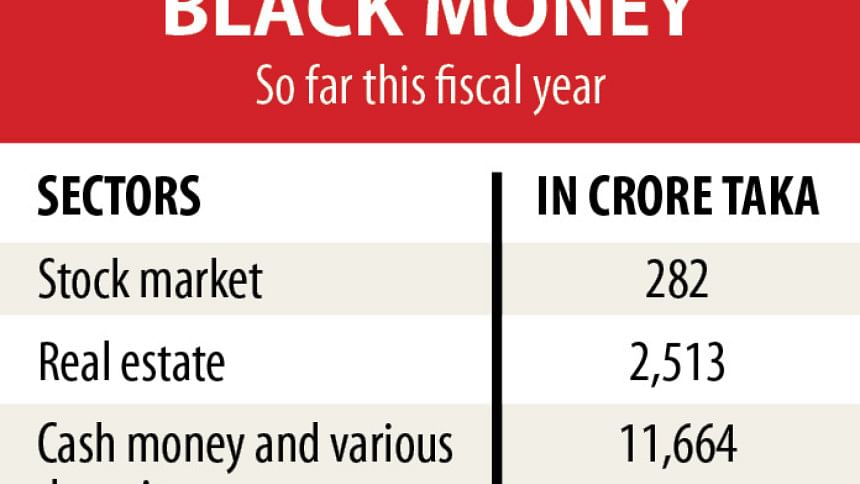

However, this is just 1.95 per cent out of a total of Tk 14,459 crore of undisclosed money legalised in tax returns until this month, according to data of the National Board of Revenue (NBR).

The NBR was able to get around Tk 28 crore as tax against this stock market investment.

The government offered the scope to legalise black money for the current fiscal year, albeit on payment of a 10 per cent tax on the amount. A total of 10,404 people availed the facility.

Of the amount disclosed, Tk 2,513 crore was whitened through investments in the real estate sector.

Another Tk 11,664 crore was legalised by taxpayers showing it as wealth in the form of cash, fixed deposit receipts, saving certificates and others, according to the NBR data. Overall, the lowest amount went through as investment in the stock market.

A top NBR official, preferring anonymity, said whatever went through the stock market was very nominal compared to the revenue authority's expectations.

The stock market's volatility, high risks and low transparency mainly barred undisclosed money's flow to the sector, said Khondaker Golam Moazzem, research director of the Centre for Policy Dialogue.

Meanwhile, listed companies are facing challenges in maintaining their performance amidst the pandemic, so people preferred avoiding the risks and keeping the money in banks, he said.

Though the prime index of Dhaka Stock Exchange (DSE) crossed 6,000 points yesterday, people apprehend that it would fall again, for which they preferred banks, he said.

This legalisation process is not how undisclosed money in the economy can be reduced, said Moazzem, adding that the government should rather fix a deadline after which it would clamp down on the owners.

The government needs to launch an integrated financial system enabling all transactions of an entity to be linked in a single system so that people cannot evade paying taxes, he added.

People were allowed to invest money in the capital market between July 1, 2020 and June 30, 2021 and show it in their tax returns on paying tax at a rate of 10 per cent on the value of the investment.

The investment came with another condition, that it could not be shifted or had to undergo a lock-in period for one year.

This year the stock market enjoyed the benefits of such unconditional investments of undisclosed income after more than two decades.

In 1998, a similar facility was given for three years to give a boost to the stock market after it crashed in 1996.

The government also allowed whitening money by keeping it in banks but it did not come with the lock-in condition, said Sayadur Rahman, president of Bangladesh Merchant Bankers Association.

So why will the undisclosed money come to the stock market, he asked, explaining that people prefer the easy process where there were no conditions at all.

Rokibur Rahman, a DSE director, echoed him.

He recommended extending the facility for the upcoming year while excluding the lock-in condition.

A top merchant bank official, preferring anonymity, said the stock market needed product diversification, transparency and checks to manipulation instead of being the place to whiten money.

If strong confidence can be grown on the market, it will be vibrant, he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments