IT exports fall for the first time in five years

IT exports from Bangladesh have fallen for the first time in five years, which is an ominous sign for the government's export diversification efforts as the country is failing to produce big IT firms.

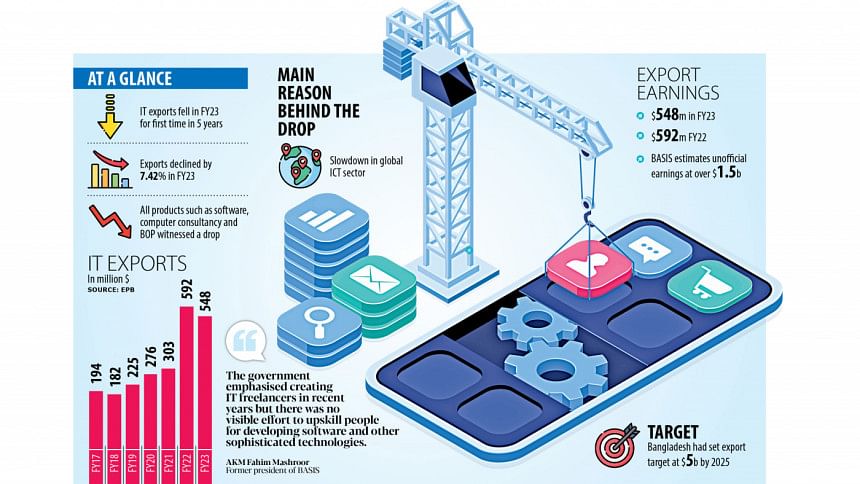

According to the Export Promotion Bureau (EPB), earnings of domestic IT firms declined by 7.42 percent compared to the previous year, reaching $548.10 million in fiscal 2022-23.

This is also a big blow to the county's target of achieving $5 billion in exports of IT and digital devices by 2025.

"The government emphasised creating IT freelancers in recent years but there was no visible effort to upskill people for developing software and other sophisticated technology," said AKM Fahim Mashroor, former president of the Bangladesh Association of Software and Information Services (BASIS).

He explained that it is difficult to boost overall IT export earnings by simply increasing the number of freelancers in the country as their individual incomes are minimal.

Mashroor also said India's IT exports is now worth more than $200 billion because the country has been able to create firms like Infosys, Wipro and Tata Consultancy Services.

"Each of these companies earns billions of dollars and employ thousands of people by developing high-end software products," he said.

Besides, tech companies around the world have downsized the number of their employees and those people now work as freelancers. "So, this has also had an impact on the overall IT exports of Bangladesh," Mashroor said.

"Another reason is that the clients of our IT firms are small startups. As venture capital investment plummeted around the world, it has had a negative effect on our exports," he added.

All segments -- IT enabled services (ITESs), and software and computer consultancy -- have experienced a negative impact in FY23.

Revenues generated from shipments of ITESs, that encompass tasks such as graphic design, image editing and business process outsourcing, declined by 5.32 percent to $458.62 million that year.

Similarly, export earnings from software decreased 19.66 per cent year-on-year to $47.85 million.

The shipment of computer consultancy services fell 8.93 percent to $34.76 million while installation, maintenance and repair of computer and peripheral equipment services witnessed a decline of 30.72 per cent to $6.88 million.

"The trend of growth in exporting software was very encouraging in the last 1 or 2 years, but from the data of the last few months, we are seeing that export is falling," said Rashad Kabir, a director of BASIS.

"One of the main reasons might be that global inflation has forced most companies in Europe and the US to cut their costs, resulting in reduced software imports," he added.

The hiring of remote developers was a popular model of working during the Covid-19 pandemic, when many software companies and individual developers from Bangladesh worked as offshore development partners.

"But in the last six months, companies have gone back to their traditional onsite work model, which might be another reason for the fall in software export," Rashad said.

He suggests Bangladesh IT companies focus on some untapped markets like Africa and Pan Pacific Asia, where there is a lot of scope to earn from providing IT/ITES.

"Companies should also focus on developing their own products rather than only providing services," he added.

Syed Almas Kabir, a former president of BASIS who is revered for his erudition in the local IT market, said there are a few concerning factors for the decline in IT exports.

"One common factor is the global recession due to war and Covid-19. For this, firms around the world are not updating their IT installations. So, our export volume has declined in line with their lower investment," he added.

The type of work local companies do is rudimentary, such as search engine optimisation and photo editing. These types of tasks are now being done through artificial intelligence and robotic process automation, effectively replacing humans.

Additionally, chatbots are replacing many BPO services.

With this backdrop, Kabir recommends local talents and firms start catering to high-value tasks, such as data analysis and decision-making.

"Such tasks will also increase the average per hour payment from $10-15 to $50-60," he said.

Besides, local expertise in new technology, such as blockchain, is very low. So, this type of skilled individual needs to be developed.

"Otherwise, our IT exports will continue falling down," Kabir added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments