Berger Paints to form Tk 60cr JV with UK firm

Berger Paints Bangladesh plans to expand its business by setting up a joint venture with UK-based construction solutions provider Fosroc International with a combined investment of Tk 60 crore.

The board of directors of Berger will soon sign a deal with Fosroc, according to a disclosure posted on the Dhaka Stock Exchange (DSE) website yesterday.

Berger will invest Tk 30 crore and hold 50 percent share in the new entity, Berger Fosroc Ltd. It will manufacture all kinds of construction materials, chemicals and related technologies.

The firm will mainly work to improve the quality of construction materials with the help of state-of-the-art technologies, said Rupali Chowdhury, managing director of Berger Paints Bangladesh.

“We will develop a professional group by providing them with training on latest construction technologies.” Berger expects to reach the break-even point in four to five years, Chowdhury said.

One of the oldest names in the paint industry, Berger Paints Bangladesh made a profit of Tk 69 crore in the half year that ended in September 2017, according to DSE data. In Berger Paints Bangladesh, sponsor directors hold 95 percent of the share, public 0.38 percent, institutions 2.56 percent and foreign shareholders 2.06 percent.

The company's shares rose sharply after the disclosure of the expansion plan. The price of its share increased by Tk 71 or 3.36 percent to close at Tk 2,186 yesterday from that of Thursday.

DAILY MARKET:

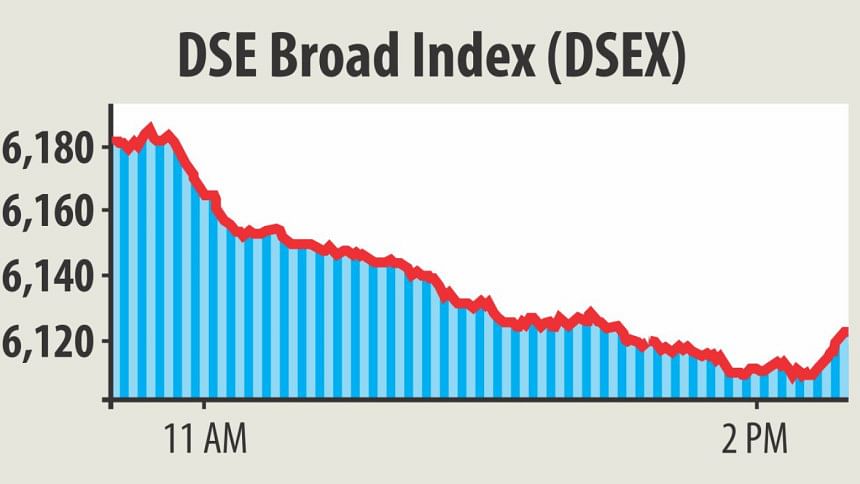

Dhaka stocks witnessed a sharp fall in price index amid sluggish turnover because of low participation of institutional and foreign investors.

The prime index, DSEX, shed 61.42 points, or nearly 1 percent, to close the day at 6,117.89. Daily turnover also fell 14 percent to Tk 328 crore from the last day of trading.

Institutional investors have refrained from making fresh investments in the market as they are waiting for the upcoming monetary policy of the central bank, a top executive of a merchant bank said.

The market naturally remains volatile before the announcement of a monetary policy, the official said. “It will become stable with the increasing participation of institutional investors.”

Bangladesh Bank plans to reduce the advance deposit ratio (ADR) in the new monetary policy for the January-June of 2018, which is scheduled to be announced this week.

Banks have already started hunting for deposits at increased interest rates to adjust to the higher ADR, a central bank official said.

Yesterday, the market opened on a flat note and witnessed a freefall amid a broad sell-off throughout the session, UCB Capital Management said in its daily market analysis.

Engineering equities led the turnover chart accounting for 23.39 percent of the total turnover.

All of the major sectors witnessed moderate correction.

On the DSE, 48 securities gained, 253 declined and 34 remained unchanged.

The DS30 and DSES indexes were 17.74 points and 7.22 points in the red respectively.

BD Thai was the highest traded share with its securities worth Tk 13.89 crore changing hands followed by Ifad Autos with Tk 13.69 crore worth of shares.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments