Banks often troubled by influential defaulters

Influential defaulters took advantage of the loan rescheduling policy repeatedly, Bangladesh Institute of Bank Management or BIBM said in a study.

“Many borrowers, especially the influential borrowers and wilful defaulters, place unethical requests and create pressure on banks to regularise their problem loans through rescheduling/restructuring without having proper justification to do so,” it said.

BIBM prepared the report, 'Implication of Loan Rescheduling and Write-off on the Performance of Banks', early this month after analysing data from 2010 to 2014 and recording statements of bankers.

The government, judicial authority, the central bank, law enforcement agencies, political parties, trade associations and the media should work to restrain bad borrowers from unethical practices, it said.

The rescheduling of delinquent loans is actually a deferral process of accumulating default loans.

The move puts immense pressure on the bank's capacity to recover the loans, which are not only “toxic assets” but will go on to become irrecoverable in the long run.

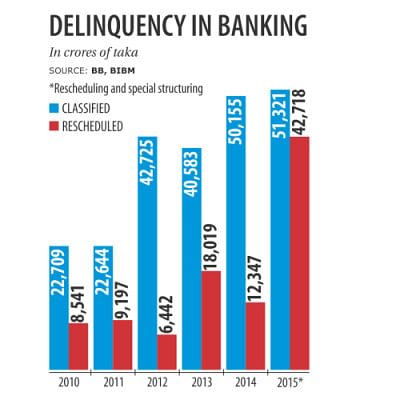

Banks on average rescheduled Tk 10,909 crore a year between 2010 and 2014, according to the BIBM study.

In 2015, banks rescheduled Tk 26,308 crore in bad loans, which is 50.1 percent more than in 2014, as per central bank statistics.

Besides, under pressure from influential businessmen, the central bank last year offered a special restructuring opportunity for loans upwards of Tk 500 crore.

Under the facility, Tk 16,410 crore was restructured in loans. The loans were already rescheduled and restructured several times.

The study shows that the recovery of rescheduled loans is small and realisation of funds from large borrowers even smaller.

It seems that banks always try to facilitate large loans or large composite loans, allowing multiple rescheduling for a longer period with negligible down-payment, interest blocking, extension of fresh loans to sister concerns, according to the study findings.

“In a sense, these practices are stimulating discrimination between good and bad borrowers,” BIBM said.

The study also revealed that most of the rescheduling is not based on the borrowers' cash flow and repayment ability.

“That's why the rescheduled loans are not recovered in most cases and eventually end up as litigated bad loans.”

Many of the borrowers do not have the entrepreneurial ability or the managerial capacity to run a business profitably, according to the study.

“Nevertheless, banks are extending rescheduling facilities to those borrowers.”

The report also said the banks should allow rescheduling strictly based on a future cash flow and repayment ability of the borrower, rather than using the facility as a stimulating instrument for non-performing loan management.

Those who have been identified as bad or recalcitrant borrowers and never paid off their loans even after multiple rescheduling facilities should be restricted from taking any fresh loan from the banking system in future, even with other entrepreneurs.

The repeated application of rescheduling and write-offs for reducing classified loans on banks' balance sheets has not yielded the intended results yet, said Zahid Hussain, lead economist of the World Bank's Dhaka office. “Such techniques work only when they are applied in truly deserving cases without repetition. Once you start rescheduling the rescheduled loans, a Pandora's box opens.”

Repeated rescheduling reduces the perceived cost of not repaying loans in time, thus encouraging and deepening the default culture, he said. “Bangladesh Bank's regulatory guidance not to reschedule loans if banks have sufficient doubt about the borrower's willingness and ability to pay has clearly not been followed.”

To ensure sustainable and prudent credit operations, more innovative approaches along with a judicious use of rescheduling and write-offs are needed to end the default culture.

“The wilful defaulters have to be held accountable, not rewarded through rescheduling. Poor enforcement of laws relating to settlement of NPLs, followed by insufficient debt recovery measures on the part of the banks, has aggravated the financial malaise.”

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments