State banks saw rapid credit growth in 2016

Four state-owned commercial banks saw higher credit growth at the end of December last year thanks to a surge in lending to small businesses.

Even two of them surpassed the credit ceiling set by the central bank.

Bangladesh Bank held a meeting with the top executives of Sonali, Janata, Agrani and Rupali banks on Wednesday to discuss their performance in line with the targets set in the memoranda of understanding the regulator has signed with the lenders.

BB Governor Fazle Kabir chaired the meeting.

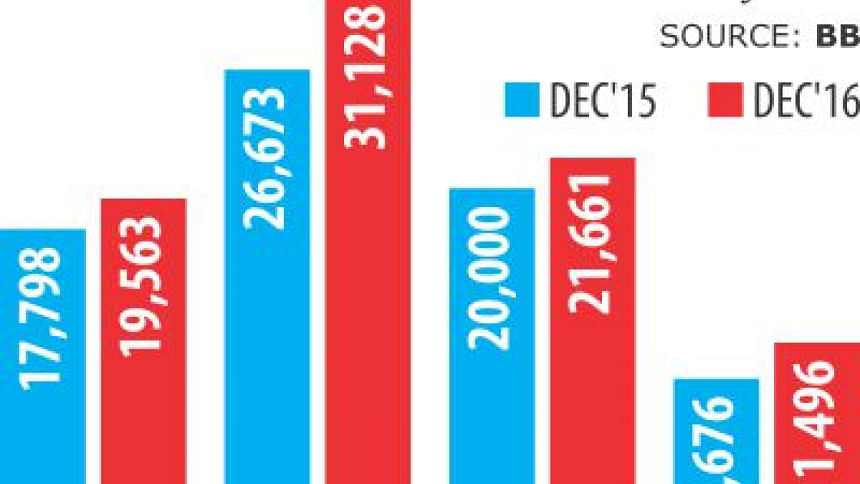

According to the MoU review report, the adjusted loan growth of Sonali Bank was 9.92 percent or Tk 19,500 crore last year compared to Tk 17,800 crore in 2015. The credit ceiling for the biggest bank in the country was 10 percent.

The adjusted loan growth excludes credits going to the government and the agriculture sector. BB set the loan disbursement target on the basis of adjusted loans.

The total loan growth of Sonali Bank was 10.85 percent or Tk 32,600 crore last year compared to Tk 29,400 crore the previous year.

The bank experienced negative credit growth of 5.26 percent in 2015 after it fell short of reaching the BB ceiling of 6 percent.

The four banks saw higher credit growth last year as the banks were focused on SME lending moving away from corporate financing, said Md Obayed Ullah Al Masud, managing director of Sonali Bank.

"We are very serious about increasing our lending to small businesses," he said.

The BB governor also expressed satisfaction over the performance of the state banks, he said.

Janata Bank surpassed the credit growth target. Its adjusted loan growth was 16.70 percent last year, up from 12 percent fixed by the central bank.

The total loan growth of the bank was 9.91 percent in 2015 against the target of 10 percent.

The bank's total adjusted loan stood at Tk 31,100 crore in 2016 compared to Tk 26,600 crore a year ago.

Agrani Bank's disbursement grew 8.31 percent last year against the 10 percent ceiling. The total adjusted loans stood at Tk 21,600 crore, up from Tk 20,000 crore a year ago. In 2015, Agrani's credit growth was 9.63 percent against the target of 10 percent.

Rupali Bank also exceeded the agreement target of 17.50 percent, registering 18.81 percent credit growth last year. The total adjusted loan was Tk 11,500 crore compared to Tk 9,676 crore in 2015. The bank's loans grew by 11.92 percent in 2015 against the set target of 12 percent, according to BB data.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments