Jamuna Bank: aiming for the top spot

Five years ago, with forged documents, Bismillah Towels made off with Tk 180 crore from Jamuna Bank -- an incident that instigated wholesale changes in the way the third generation lender functions.

"Now, there is no chance of a loan scam like that," Shafiqul Alam, managing director of Jamuna Bank, recently told The Daily Star in an interview.

Soon after the loan scam in 2012, Jamuna introduced a centralised banking system, one in which the branch officials do not have the authority to give the green light to loan proposals without the permission of the head office.

"Many banks are resisting the switch to centralised system because of manpower cost, but they should, if they want to reduce risks of loan scams."

In the traditional system, branch officials always remain susceptible to collusion with ill-intentioned borrowers.

Jamuna has also introduced world-class core banking software to manage risk and improve its service standards.

The incident, it can be said, has been a turning point for Jamuna in all respects, and Alam, who joined the bank in 2013, is spearheading the positive changes.

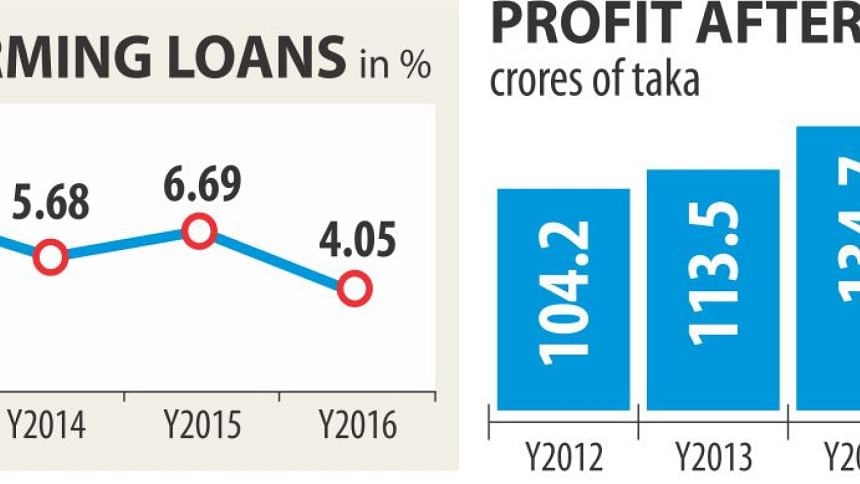

The bank's non-performing loan has come down to 4.05 percent in 2016 from nearly 10 percent in 2012. Its other indicators, such as loans, deposits, net profit, earnings per share or cost to income ratio, have all been on an upward trajectory.

The increasing efforts to render better services to customers are also working out well for the banks' sponsors and general shareholders: for 2016, Jamuna paid 20 percent dividend, which is the highest in five years.

In 2016, the bank logged in Tk 450 crore as profit, and Alam expects it to hit the Tk 500 crore mark this year.

Emboldened by the financial stability it regained, Jamuna is now branching out into lending to small and medium enterprises.

The bank has set a target to raise its SME loan exposure to 18 percent of its total loan portfolio by the year end from 14 percent now.

"We get better rates from SME loans and the default rate is also low," said Alam, who started his banking career at ANZ Grindlays Bank.

The lending rate in the banking sector may face an upward pressure soon due to the rising credit demand in the private sector.

The interest rate on deposits has already started creeping upwards in July, breaking a downtrend of two and a half years, according to Bangladesh Bank data.

The weighted average interest rate on deposits stood at 4.89 percent in July, up from 4.84 percent in June.

The interest rate had been on a descent since January 2015, when lenders provided 7.26 percent.

Private sector credit growth hit 16.94 percent in July -- the highest in five years and well above the 16.2 percent target set by the central bank for the first half of 2017-18.

Jamuna saw a 25 percent growth in private sector credit in June, which is way above the industry average, Alam said.

The bank put in more effort to improving the size of its loan book to overcome the losses caused by the Bismillah scam.

"We have already overcome the losses by improving the quality of loans we disbursed in the last two years."

In 2012, the bank's total outstanding loans were Tk 5,000 crore, which soared to Tk 12,700 crore at the end of June this year.

Jamuna is now aiming to be among the top banks in the five years, he said.

"The market is very competitive due to the high number of banks."

Previously, the central bank would have to force banks to bring down the interest rate but with little success.

"Now, the interest rate is falling automatically. There is no need for the authorities to interfere in this aspect."

Alam is most excited by the prospects in the SME sector as Bangladesh's economy expands.

"The pricing of SME products is high and at the same time the default rate is low."

About the rising demand for consumer financing, he said the purchasing power of the middle-class is fast expanding.

"By and large, retail loans are risky, but consumer financing is still a very small portion of the industry's loan portfolio."

Consumer credit rose 31.29 percent year-on-year to Tk 29,500 crore in 2016, according to data from the BB. The segment accounted for 4.37 percent of the total outstanding loans in the economy.

As of June, Jamuna has 112 branches across the country with 2,495 employees.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments