Apparel growth hinges on reining in labour unrest

Mohammadi Group, a leading garment exporter, will address three important factors in 2017 to maintain its 10 percent year-on-year business growth. The company will expand its operations, complete remediation and produce more value-added items.

Expansion will ensure higher productivity, remediation will brighten image of the company and value-added products will give the manufacturer a competitive edge, said Rubana Huq, managing director of the group.

These three factors are important for almost all the 4,000 active garment factories that employ more than 4.4 million workers.

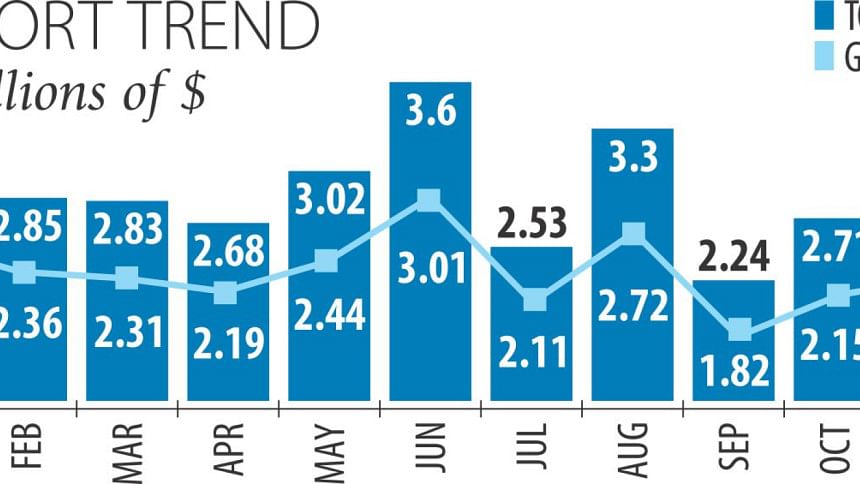

The $28.24-billion-export sector saw more than 10 percent growth in shipment in 2016 amid higher demand from international retailers.

Industry insiders said 2017 will be a great year as well if some issues are addressed properly.

“Expectations from 2017 are not too high, but we will produce more value-added products this year,” Huq said.

Mohammadi Group will focus more on research and development in 2017 as this is the only way forward, she said.

“Most of all, I hope the labour issues will be addressed by positive intervention from brands and entrepreneurs, in order to turn 2017 into a far more productive year.”

Many factories in Bangladesh were busy relocating and remediating in 2016. So, it was indeed a year of positive changes along with a rise in exports, Huq said.

“There's already been enough investment. But, yes, we are still expanding and aiming for product diversification,” said Huq, who exported $110 million worth of garment products in the outgoing year from her four woven and four knitwear factories, which employ about 12,000 workers.

The biggest challenge now is to ensure that the sector will run smoothly without any interruption by labour unrest.

“Wage is another challenge. While the labour sector demands more, our revenue is not increasing at that pace. Efficiency is also a critical factor. The country is still running at less than 50 percent productivity,” Huq said.

“On top of all, we have compliance challenges to handle. The sector, until 2018, will see a lot of new turns.”

However, like Huq, all things are not so settled for the newcomers or potential investors, as the sector has been going through massive reforms following the Rana Plaza building collapse in 2013.

For instance, Jahan Akhter Seema, managing director of Aeon Apparels and Maan Fashions, has been facing a lot of troubles to start production at her new factory in Ashulia.

Seema, a merchandiser-turned-entrepreneur, has already invested nearly Tk 60 crore in her factory, which is expected to employ more than 10,000 workers and export more than $2 million worth of garments a month.

“The biggest challenge in 2017 would be the labour unrest as it has already been seen in Ashulia, and higher bank interest rate,” Seema said. If labour unrest can be contained, growth in garment exports will be more than 10 percent or beyond, she said.

The bigger and older companies can survive shocks, but the new ones cannot, she added.

“So, for them a peaceful production environment is necessary,” said Seema, who has been involved in garment business since 2008 either as a merchandiser or a small entrepreneur.

In 2017 also, Bangladesh will remain the second largest garment supplier worldwide as exports will continue to grow, sector people said.

They also identified some challenges -- a lack of skilled workforce, implementation of the compliance schemes, poor infrastructure, weak road transport and poor management of the country's premier seaport through which more than 80 percent of overseas trades are carried out.

The industry must address the issues of gas and power crises, market diversification, access to new markets and political stability for achieving the targeted export growth in 2017, analysts said.

The country should take preparations from now to retain the duty benefit in the EU market, the largest trade bloc for the country's export, as Bangladesh is on the way to become a middle income nation by 2021.

With the graduation into a middle-income country, Bangladesh will have to work further on human rights, governance, protection of environment and labour rights to continue enjoying duty benefits in the EU market.

The industry owners are busy with remediation through the corrective action plans, recommended by Accord and Alliance -- two foreign inspection agencies -- and the government.

Factory owners are hopeful that they can complete the remediation works of their factories by the end of 2017.

The other challenges include brightening the image of the sector. The militant attack on Holey Artisan bakery on July 1 took a toll on the country's image as well as businesses.

Nine Italians, seven Japanese, three Bangladeshis and an Indian were killed in the attack.

All the Italians killed were garment retailers, who had been doing business with Bangladesh for many years. Italy is the sixth largest garment export destination for Bangladesh and Japan is the largest Bangladeshi apparel importer among Asian nations.

Garment exports to the UK witnessed slowed growth in 2016 mainly for two reasons -- Brexit and a ban on direct air cargo shipment from Bangladesh to the UK.

Brexit caused depreciation of the pound sterling for which exports to the UK became costlier amid cautious spending by the Britons.

Usually, garment exports to the UK maintain nearly 10 percent year-on-year growth, but shipment declined below 1 percent during July-October of the current fiscal year compared with the same period of last fiscal year.

The UK is the third largest export destination after the US and Germany. Bangladesh ships more than $3 billion worth of garment products to the UK in a year.

Apart from the UK, garment export to other EU nations maintained good growth across the year.

The US remained the top garment export destination also in 2016 despite the suspension of the GSP. Bangladesh exported nearly $6 billion worth of garment items to the US in 2016.

In 2016, some Asian markets like China, India and Japan showed very promising signs. Bangladesh's garment export to Japan and China may cross the $1-billion mark in 2017.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments