The What, Why and Who of Mobile Banking

Bangladesh began its mobile banking journey in 2011. The primary goal of mobile banking, also commonly referred to as mobile financial services (MFS), is financial inclusion – reaching the unbanked population with appropriate financial services. At the broadest level, MFS constitutes offering financial services that include, but not limited to, funds transfer, savings products, insurance products, paying fees of various forms (utility, education, etc.), and receiving payments (from employers, government, etc.). However, in the initial stages of market development, funds transfer services have been the most predominant form of MFS in Bangladesh.

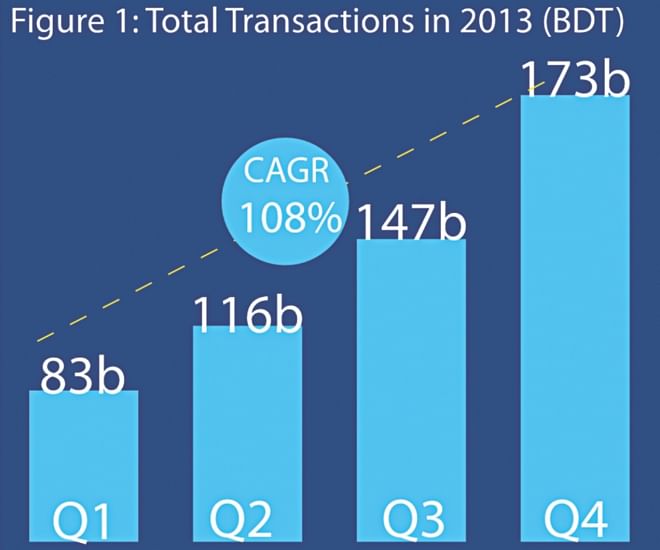

Mobile banking sector is a growth story already. By the end of December 2013, there were more than 13 million registered users served by about 180,000 agents transacting over TK65 Billion per month (see Figure 1). In 2013, the number of registered MFS users grew at about 12 percent each month, with a CAGR of 266% (see Figure 2). At the start of the year there were only 3.6 million registered users, but that number reached 13.2 million by the end of December 2013.

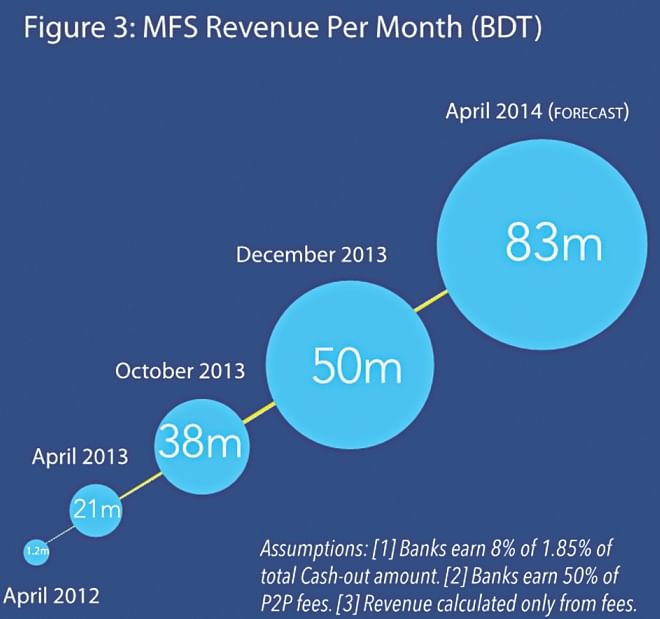

Bangladesh Bank has approved 28 banks to provide MFS in the country. Almost 20 of those have officially launched MFS services so far. pi Strategy Consulting analysis indicates that the revenue stream for banks have experienced significant growth recently (see Figure 3).

There are several factors that collectively contribute to the proper functioning of any MFS operation. Regulatory environment, business model, agent network, technology, partnerships, and user adoption are among them. But perhaps, user adoption is the most important of them all since the ultimate test of a product is whether the end-customers find that product valuable and use it. A closer look at the consumer needs, therefore, can inform the design and growth agenda for a product.

pi Strategy Consulting in partnership with CGAP of World Bank, conducted in-depth research on MFS consumer needs over a 6-month period in 2013. This research, focusing solely on the consumer needs of MFS end-users, is the first of its kind in Bangladesh. The research findings were launched officially in February 2014, where the Chief Guest at the event, Dr. Atiur Rahman, Governor of Bangladesh Bank, said this work was "the most comprehensive study on mobile financial service customers' insights that has ever been conducted in Bangladesh." The remainder of this article draws from this research to share some insights. A summary report is available for download at http://www.pistrategy.org.

Customers seem to have adapted their own ways of using MFS platforms. A few people are opening wallets to conduct person-to-person (P2P) transfers or merchant payments, most people are transacting through agents without using personal wallets, some are doing both based on the situation and personal need.The consumers have leveraged the MFS platforms in different forms. For this particular study, the transactions were categorized into three different transaction modes. If neither the sender nor the receiver uses his own mobile banking account (or wallet) to complete the transaction, it is categorized as a Pure OTC transaction. If either the sender or the receiver uses his own wallet for a transaction it is categorized as Partial OTC. And if both the sender and the receiver use their own wallets for a transaction, it is categorized as Pure Wallet.

This survey found that the most popular mode of

transaction is Pure OTC (52%), followed by Partial OTC (35%) and Pure Wallet (3%). Post office and courier services collectively were used by 10% of those surveyed.

Nearly 48% of the MFS users reside in urban areas while 32% in rural and 20% in semi-urban areas. Though the sender receiver split is roughly 50-50 across the nation, the research suggests that rural users are more likely to receive money, rather than send money. The research shows a big gender gap among the users, only 18 percent of them are female.

The average monthly income of MFS users is about TK 8,000, which is lower than the national average, and nearly three times the poverty line average income. Majority of the MFS users don't have bank accounts in formal financial institutions. Pure Wallet users have higher individual monthly income (TK 10,642) compared to others. At the other end of the spectrum, Pure OTC users earn the least (TK 7,093 per month). Partial OTC users earn TK 8,361, post office users earn TK 8,475 and courier service users earn a slightly higher amount of TK 9,650 on a monthly basis.

The average ticket size of MFS transactions is TK 3,370, which is much lower than other platforms. Ticket size of courier service transactions is five times that of MFS. Much of the low value transactions are flowing through MFS. The cost associated with the transfer is certainly a factor for this trend. It is cheaper to send smaller amounts of money through MFS than through other modalities such as courier service.

More than four fifths of users transfer funds between the members of same economic households. 90% of Pure Wallet, 86% of Pure OTC and 81% of Partial OTC users transfer funds between the same economic household members.

This pi Strategy Consulting study affirms that a transition from OTC to wallet usage is underway in Bangladesh. Different factors are driving this transition. 95% of the users cited trustworthiness as the most important influencing factor towards wallet usage. However, wallets are yet to be perceived as savings tool, with only 5% the wallet users viewing it as such.

Retail mobile banking agents interact directly with the users and they are expected to assist with wallet adoption. This research finds that agents are positively influencing customers to open wallets. But because of their personal financial benefit from OTC transfers, agents are not encouraging wallet usage as strongly.

In the random sample, 25% were found to have wallets. A large number of them have opened wallets very recently – in Q3 of 2013, which indicates there has been a recent shift to wallet opening. However, only 3% of them conduct Pure Wallet transactions. The remaining 22% are conducting Partial OTC or Pure OTC transactions. Many of those who are not opening wallets just yet are citing inadequate need as the primary reason. However, this may be viewed in at least two ways. First, there actually may not be as strong a need. Second, there may be latent need for wallets, but this has not translated into explicit need in the minds of the consumers.

There are many areas within mobile banking that still need to be worked out. This is not unexpected. After all, this market is still in the early stages of development. However, if there is one thing that all indicators and analyses point to, it is the significant opportunity that mobile banking can bring to the consumers, the MFS deployments, and the ecosystem partners.

pi Strategy Consulting is a management consulting firm specializing in strategy and innovation, and a recognized thought leader in mobile banking. Pial Islam, Sudip Chowdhury, Amit Roy, Saleh Sobhan, and Shuvajit Mandal have collectively contributed to this article.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments