$500m at best from WB this fiscal

The government can expect budget support of $500 million at best from the World Bank this fiscal year after it failed to implement key reforms that would have unlocked the entire $1 billion it was seeking.

As per the original plan, $250 million was supposed to come from the Green, Resilient Inclusive Development (GRID) programme and another $250 million from the Development Policy Credit (DPC) scheme.

Further amount would have been mobilised were the government able to meet more conditions, which would have been tangential to DPC's.

The government has more or less met the conditions for the GRID but is yet to meet any of the 12 conditions for DPCs, which encompass reforms in fiscal policy and the financial sector and setting guardrails to future shocks.

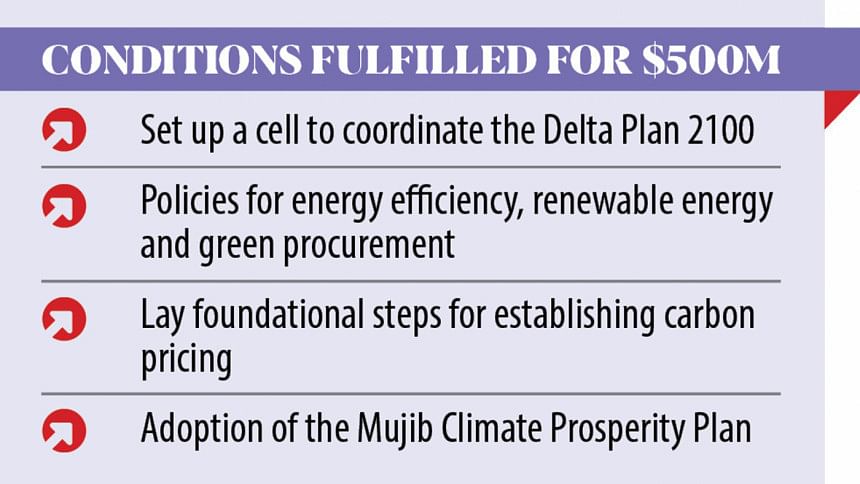

The conditions for GRID include setting up a cell in the planning ministry to coordinate the Delta Plan 2100, policies for energy efficiency, renewable energy and green procurement and so on, foundational steps for establishing carbon pricing.

Adoption of the Mujib Climate Prosperity Plan figures high, too.

This plan, which was recently passed in the parliament, includes retrofitting the built environment, following the National Building Code 2020, to ensure sustainability and to make sure the buildings are safe against disasters and emergencies.

Now, to accommodate the government's budget support needs for this fiscal year, the Washington-based multilateral lender has decided to make more funds available under the GRID programme.

Subsequently, at a tripartite meeting on March 2 involving the Economic Relations Division and the line ministries, it was decided that funds would be diverted from the WB-funded slow-moving projects to the GRID programme.

The implementation status of six projects was discussed, and it was decided that most of the funds for the GRID programme would be made available from two projects: operation for supporting rural bridges and investment promotion and financing facilities II project (IPFF II).

As is practice, when the WB sanctions amount for projects, that gets added to the foreign aid pipeline. Only when the implementing agencies furnish invoices against the projects do the lender release the funds.

The implementing agencies of the two projects have been able to present invoices amounting to only a fraction of the sanctioned amount.

The IPFF II is a $356 million-project that was taken up in April 2017 for completion by June last year. As of June 2021, only $48 million was used.

So, the WB has decided to leave $100 million for the project and re-route the remaining amount to the GRID programme.

Similarly, the operation for supporting rural bridges is a $425 million project taken up in April 2017 for completion by August this year. As of June 2021, less than $15 million was used.

Subsequently, the lender has decided to leave $85 million for the project and channel the rest to GRID.

The proposal will be sent to WB board for final approval, according to officials involved with the proceedings.

As for the DPC programme, the government was hoping to meet the 12 conditions for the programme by January this year.

But it is unlikely that the conditions would be met before September.

One of the conditions is amendments to the Bank Company Act to strengthen the supervisory framework in line with good international practice, which is also a condition under the International Monetary Fund's $4.7 billion loan programme.

The WB has called for a recovery plan for undercapitalised banks and strengthening corporate governance in state banks in line with global best practices.

Another condition is getting the cabinet to approve the National Tariff Policy, which would bring down the tariffs and simplify the tariff structure.

The commerce ministry has approved the framework for the policy, including institutional responsibilities and implementation arrangements.

Rolling out the automated challan system for deducting income tax at-source in all tax zones across the country by fiscal 2023-24 is another condition put forth by the WB.

The WB also called for full implementation of the e-Government Procurement system, which would bring down the average procurement lead time (from invitation to contract award) to 50 days from 70 days at present.

For that to happen, the Bangladesh Public Procurement Authority (BPPA) Act must be enacted to consolidate the responsibilities and authorities of the BPPA.

The Department of National Savings must adopt an automated system to link the issuance of the General Provident Fund and the Contributory Provident Fund instruments to national identity cards.

Modernising the financial system infrastructure to global standards by adopting the Payment and Settlement Systems Act 2021 and the Secured Transactions Act are the other triggers for the loan.

One of the conditions for budget support is expanding cash transfer programmes this fiscal year by more than five times to cushion the poor from the brunt of the elevated price levels at home and abroad.

Cash transfers of Tk 24,040 crore must be made to the mobile financial service accounts of the reclassified list of beneficiaries by the ministry of social welfare.

Another condition is the use of the National Household Database for beneficiary identification by major social protection programmes.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments