IMF's new debt policy unlikely to impact Bangladesh

The proposed reforms to IMF's debt limits policy for low-income countries are unlikely to affect Bangladesh due to its sound external borrowing position.

The International Monetary Fund forwarded the proposal to the finance ministry last month for the government's opinion, and the ministry already held a series of meetings over it.

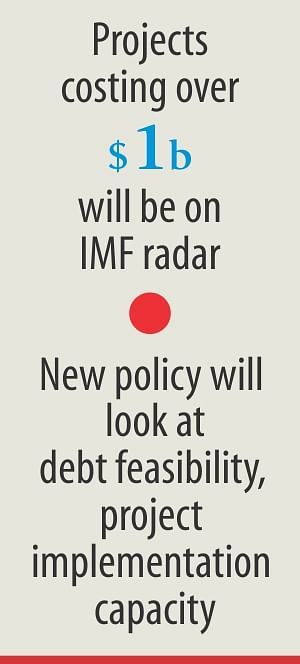

Essentially, the multilateral lender will monitor projects involving loans in excess of 1-2 percent of gross domestic product (GDP) if their debt sustainability is in question. In other words, if the countries take out loans over $1 billion, the projects will come under the purview of the IMF.

At present, the IMF only puts slabs on hard-term borrowing from overseas if the government enters any IMF programme such as Extended Credit Facility. But it does not monitor any project or any loan for this.

Under the new policy, the IMF will see whether the borrowing ensures debt sustainability over the medium term, and any planned public investment is feasible in terms of implementation capacity.

The policy will also look at the economic rationale and financing arrangements for macro-significant projects.

Zahid Hussain, lead economist for the World Bank in Dhaka, said Bangladesh's risk of external debt sustainability is low even after considering the non-concessional financing-based projects that are in the pipeline.

In Bangladesh, the 'economic rationality' of all foreign-funded projects is assessed rigorously by the donors in particular and also by the implementing agencies, he said.

The debt management capacity of the finance division and the Bangladesh Bank are in the process of being strengthened.

“I therefore don't expect any difference to Bangladesh's medium-term borrowing policy after the new debt limit policy of the fund for low-income countries comes into effect,” Hussain added.

He said ensuring debt sustainability and sound borrowing policy over the medium-term is a good idea, as the Latin American debt crisis of the early 80s and the more recent debt crisis have re-established the importance of stronger due diligence and surveillance of debts.

"Bangladesh has done very well on this front with an almost flawless record on prudent debt accumulation and timely debt servicing," he told The Daily Star yesterday.

The IMF recently assessed Bangladesh's debt situation and the results indicated that the country remained at a low risk of debt distress.

The report, which was released in December last year, took into account the probable issuance of $1 billion sovereign bonds with 10-year maturity in 2014-15 and non-concessional borrowing of $6 billion to construct two 1,000 megawatt nuclear reactors between 2017 and 2021.

“The present value of total public debt rises very slightly as a share of GDP over the first two years, and then declines over the medium-term. The risk of external debt distress remains low in this scenario.”

In low-income countries, the debt limits policy currently focuses more on the terms of the borrowing rather than on the volume of borrowing, Laurence Allain of the IMF's Strategy, Policy, and Review Department, said on its website.

“We would like to strengthen the focus of the policy on safeguarding debt sustainability, which implies paying more attention to the amount of borrowing—a country's overall debt. After all, regardless of the terms, if you borrow too much, you will eventually run into debt problems.”

The first objective of the proposed debt limits policy is to balance the need to ensure that low-income countries are still able to secure adequate financing for their long-term development, Allain said.

“So we need to ensure that there is enough flexibility in the debt limits policy to give countries sufficient leeway to manage the financing that they need. Within a sustainable borrowing envelope, they should be able—when appropriate—to tap the new sources of financing that are available to them, including non-concessional financing for projects with high rates of return.”

Meanwhile, a finance ministry official said the new policy would not be applicable to the current Extended Credit Facility loans as its tenure would end before the new limits take effect. The policy will be applicable to any future loan to be disbursed by the lender.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments