Sugar refiners relieved of advance tax

The National Board of Revenue (NBR) has relieved sugar refiners of advance tax (AT) on import of raw sweeteners for processing -- a move that will reduce pressure on their working capital.

The move comes one and a half years after the revenue authority introduced the AT in July 2019 under the VAT law 2012 in order to ensure that firms maintain records of transactions.

The NBR said the value added tax (VAT) was 5 per cent and refundable after adjustment of the payable VAT. In reality, a number of businesses are yet to get refunds of excess VAT.

Sugar refiners are one of those.

A senior official of the NBR said it decided to remove the AT on raw sugar import as the VAT was exempted at the production stage.

"As no VAT is generated at manufacturing stage, refunds are generated and refiners have to wait for refunds. As there is no VAT at production stage and cost of funds of refiners increases because of obligation to pay the AT, we have withdrawn the AT on raw sugar import," he said.

Biswajit Saha, director for corporate and regulatory affairs of City Group, welcomed the NBR step.

"No refund will be generated in future as we will not have to pay AT during imports," he said, adding that refund claims of roughly Tk 400 crore from sugar refiners remained pending for clearance at the NBR.

The City runs one of the biggest refineries having a processing capacity of 5,000 tonnes a day.

Bangladesh annually requires 18-20 lakh tonnes of sugar and imports meet 95 per cent of the domestic demand as local production is scanty.

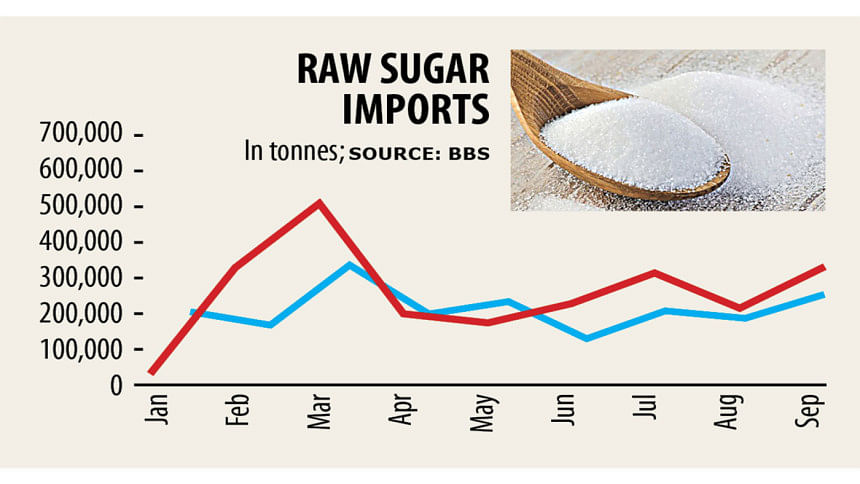

Raw sugar imports soared 36 per cent year-on-year to 27 lakh tonnes in the January-September period of 2020, according to data of the Bangladesh Bureau of Statistics.

The NBR issued the notification at a time when prices of sugar were increasing, thanks to its upward trend in the international market.

Prices of each kilogramme of sugar rose 6 per cent to Tk 65-Tk 70 yesterday in the city markets from Tk 62-65 a month ago.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments