Dollar suddenly becomes dearer

A frequent traveller who often buys foreign currency from an international bank in Dhaka was charged about Tk 86 for a US dollar on Wednesday. Just a month ago, he bought a dollar for Tk 83.

This sudden rise in dollar price might not make much of a difference to individuals who purchase foreign currency in small amounts and infrequently, but for importers who have to settle huge bills, it is a major blow.

For instance, if the price of a dollar goes up by even Tk 1, the importer has to bear an additional cost of Tk 10 lakh for $1 million.

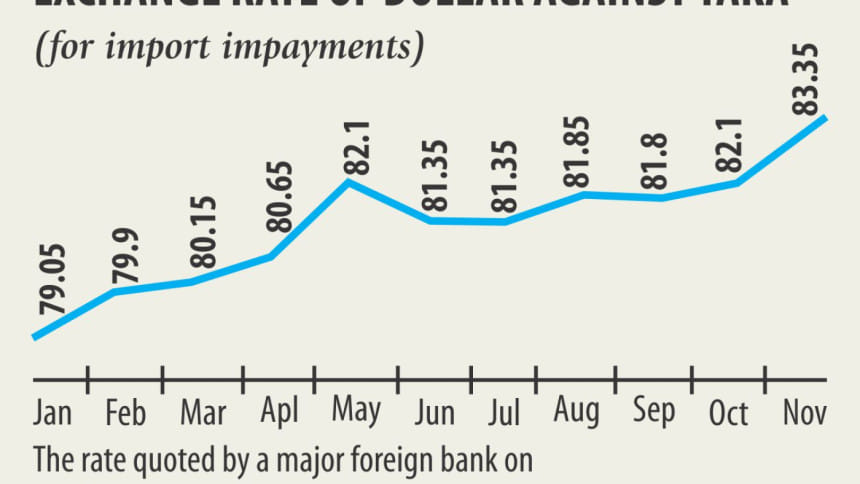

Presently, the bills for collection sell rate (at which import payments are made) of a dollar hovers around the Tk 83-mark and the rate goes up further for foreign banks that dominate the currency market.

The situation has forced the Bangladesh Bank to intervene, sitting down with the banks and treasury officials twice in the last two weeks other than selling greenbacks.

Bankers blamed the depreciation of the local currency on the mismatch between demand and supply of the dollar.

Remittance and exports, the two major sources of foreign currency for Bangladesh, are in the slow lane, while imports have ballooned.

Yesterday, the inter-bank exchange rate of the US dollar stood at Tk 80.95, up from Tk 78.49 a year earlier.

The central bank has already sold $126 million to banks this month to halt the depreciating trend of the taka, according to a Bangladesh Bank official.

“But it is not yielding the desired result as the demand for the US dollar continues to rise.”

From July 1 to November 9, the central bank has sold $440 million to banks. In contrast, it sold $175 million and purchased $1.93 billion during the course of fiscal 2016-17.

Some banks are now trading the US dollar with each other bypassing the inter-bank exchange rate set by the central bank, meaning that they completed the transaction beyond the rate, the BB official said.

The central bank has put a cap on the US dollar at inter-bank exchange rate plus Tk 2 on April 27 in a meeting with the Association of Bankers, Bangladesh with a view to keeping the market stable.

Besides, on Monday it warned a number of banks for such unethical practice and asked them to strictly follow the inter-bank rate to settle foreign exchange transactions among them.

“Some banks had secretly struck up deals between themselves,” said Md Arfan Ali, managing director of Bank Asia, adding that the banks were forced to settle transactions at the higher rate because of the scarcity of the US dollar.

Banks usually do not get greenbacks from the central bank, which compelled them to settle the deal avoiding the inter-bank rate, said Syed Mahbubur Rahman, managing director of Dhaka Bank.

Subsequently, he urged the government to take initiatives to increase export earnings and remittances to ensure steady supply of the US dollar.

“The current account balance posted a huge deficit in the first quarter of the fiscal year. This reflects the existing foreign currency shortage,” he added.

Between the months of July and September, the current account deficit stood at $1.79 billion, in contrast to $539 million in the surplus a year earlier, according to data from the central bank.

During the period, the trade deficit widened to $3.65 billion from $1.56 billion a year earlier.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments