Banks' operating profits improve

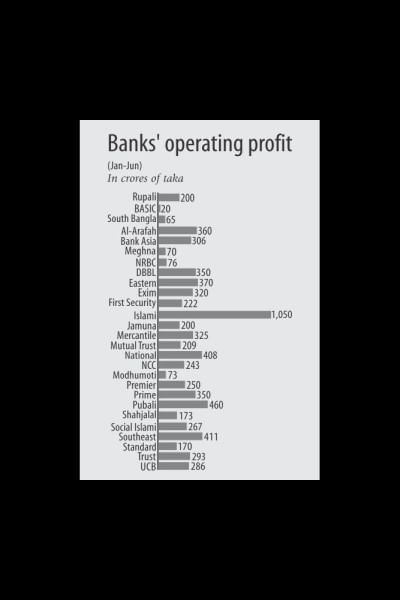

Banks have made hefty operating profits in the first six months of 2017, despite excess liquidity and falling lending rates.

Bankers attributed the healthy profit to the diversified business policies and political stability in the country.

Operating profits mean a bank's gross profit less operating expenses before deduction of interest and taxes.

From January to June this year, Rupali Bank's profit rose over six fold to Tk 200 crore from Tk 32 crore last year.

The increase in loan disbursements, mainly SME loans, contributed to the rise in profits, said Ataur Rahman Prodhan, managing director of the state-owned bank.

Moreover, the bank managed to recover a big portion of its classified loans in this period, he said.

Hit by scams, BASIC Bank made a profit of nearly Tk 20 crore thanks to its growing earnings from interest of loans, said Alauddin A Majid, chairman of the state-run lender. However, the bank incurred a loss of Tk 46 crore in the six months till June last year.

The income from investment was also good in 2017, Majid said.

Some new banks also recorded over 100 percent growth in operating profits.

Islami Bank Bangladesh—the largest private lender in terms of deposits and advances—has booked Tk 1,050 crore as operating profits, up from Tk 853 crore in the same period last year.

Despite a sharp fall in lending rates, banks made good profits as they have diversified their business in SME, retail, house building, consumer and credit card, said Mohammed Nurul Amin, managing director of Meghna Bank.

Some banks are giving more emphasis on credit card business due to higher interest rates, he said.

Rising exports and imports are also helping banks to earn more as the transactions are made through the banking channel, he said.

Non-funded business and commission income helped banks make the profit, said Ishtiaque Ahmed Chowdhury, managing director of Trust Bank.

The main challenge of the banking sector now is to manage the classified loans, he said.

Many banks showed inflated profits by rescheduling classified loans which is not a good sign, he said.

At the end of March this year, the total non-performing loan of the sector stood at Tk 73,409 crore or 10.53 percent of the total outstanding loans. The figure was Tk 62,172 crore at the end of December last year. Private commercial banks are responsible for the spike in such loans, as their default loans rose by Tk 6,670 crore in the three months till March this year.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments