budget

Govt sees budget surplus of Tk 11,865cr in Q1

The government saw a budget surplus of Tk 11,865 crore in the first quarter of the current FY due to lower spending

Gadgets on a budget: Things you need to know about geysers and heaters

Geysers and room heaters are not just appliances; they bring comfort and warmth to families.

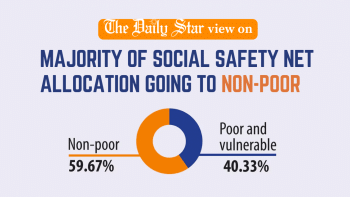

Why is government support for poor going to non-poor?

Only 40 percent of social safety net budget catering to poor, vulnerable groups

Utilising Funds: Health ministry fares worst, yet again

The health ministry continues to struggle with utilisation of funds allocated in the national budget, like it did in the past few years.

Reining in inflation top priority

The government is going to unveil a Tk 7,61,785 crore budget for the next fiscal year on Thursday, setting containment of high inflation as a major target.

Raging Inflation: Not much help on the way for the poor

Even though poor people are struggling to make ends meet amid runaway inflation, the government allocation for social safety net programmes may not increase much in the next fiscal year.

Budget FY 23-24: IMF conditions, inflation, polls 3 key issues

Three issues would be dictating the upcoming fiscal year’s budget, the last of the Awami League government’s present five-year term: the International Monetary Fund’s conditions, the persistently high inflation and next year’s national election.

Record subsidy allocation not enough

The record subsidy allocation of Tk 82,745 crore is set to be topped up with another Tk 27,360 crore in the revised budget in the face of demands from ministries even after the notable price hike of gas, electricity and fuel.

2023 will be the year of inflation and financial turpitude

While the government is distracted by elections, the financial economy will suffer

Govt sees budget surplus of Tk 11,865cr in Q1

The government saw a budget surplus of Tk 11,865 crore in the first quarter of the current FY due to lower spending

Gadgets on a budget: Things you need to know about geysers and heaters

Geysers and room heaters are not just appliances; they bring comfort and warmth to families.

Why is government support for poor going to non-poor?

Only 40 percent of social safety net budget catering to poor, vulnerable groups

Utilising Funds: Health ministry fares worst, yet again

The health ministry continues to struggle with utilisation of funds allocated in the national budget, like it did in the past few years.

Reining in inflation top priority

The government is going to unveil a Tk 7,61,785 crore budget for the next fiscal year on Thursday, setting containment of high inflation as a major target.

Raging Inflation: Not much help on the way for the poor

Even though poor people are struggling to make ends meet amid runaway inflation, the government allocation for social safety net programmes may not increase much in the next fiscal year.

Budget FY 23-24: IMF conditions, inflation, polls 3 key issues

Three issues would be dictating the upcoming fiscal year’s budget, the last of the Awami League government’s present five-year term: the International Monetary Fund’s conditions, the persistently high inflation and next year’s national election.

Record subsidy allocation not enough

The record subsidy allocation of Tk 82,745 crore is set to be topped up with another Tk 27,360 crore in the revised budget in the face of demands from ministries even after the notable price hike of gas, electricity and fuel.

2023 will be the year of inflation and financial turpitude

While the government is distracted by elections, the financial economy will suffer

Dollar crisis to go by next June

Bangladesh Bank is anticipating the pressure on the balance of payments will blow over by the end of this fiscal year thanks to hearty assistance from development partners –-- an outlook termed wishful by economists.